Background:

Understanding commodities are vital to gauge the performance of other asset classes such as bonds, equities, and even currencies. Since, 2014, any regular follower of financial markets would be able to recall that how devastating the drop in oil prices has been for many countries like Russia, Brazil, Mexico, and Malaysia whereas net importers of oil like India have largely benefitted from it. Hence, it is of utmost importance to investors to keep a tab on the trends in the commodities market.

Historically speaking, a rise in commodity prices has triggered a vicious chain reaction. First, the prices of commodities go up, which in turn triggers a rise in inflation, which again has historically triggered selloffs in bonds, which has not been good for equities in some cases.

In this Commodities Watch we present to our readers, the performance of commodities, which in turn decide the well-being of many commodity producing and consuming nations. For example, the price of Cocoa is extremely important for Ivory Coast, which is the biggest supplier of the commodity.

For another Example, India is set to import record wheat this year; hence, the wheat price is of utmost importance for inflation in India.

Biggest producers:

- Rough Rice – India, China, Indonesia, Bangladesh, and Thailand

- Soybean – United States, Brazil, Argentina, China, and India

- Canola oil – Indonesia, Malaysia, China, European Union, and the United States

- Corn – United States, China, Brazil, India, and Argentina

- Wheat – China, India, United States, France, and Russia

- Oats – Russia, Canada, Poland, Australia, and Finland

Biggest Consumers:

- Rough Rice – China, India, Indonesia, Bangladesh, and Vietnam

- Soybean – China, United States, Brazil, Argentina, and European Union

- Canola oil – China, European Union, India, United States, and Indonesia

- Corn – United States, China, European Union, Brazil, and Mexico

- Wheat – European Union, China, India, Russia, and United States

- Oats – European Union, Russia, United States, Canada, and Australia

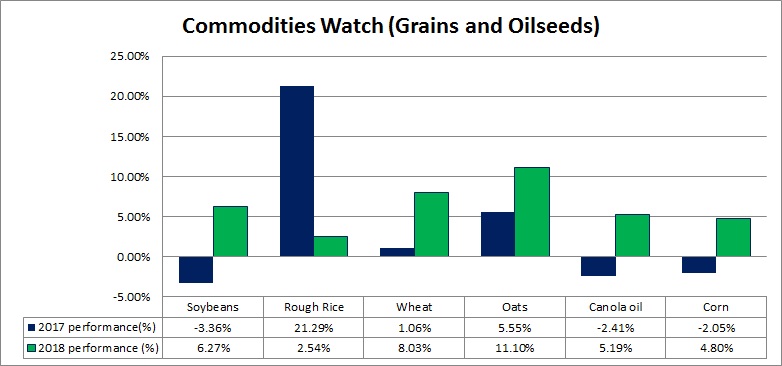

2017 performance:

In this article, we evaluate the performance of the grains and oilseeds, which are consumed by the almost entire world.

- The best performer of this pack was Rough Rice (21.3 percent); it didn’t perform too well last year. In 2016, it was down more than 21 percent.

- After being the best performer in 2016 (14 percent), Soybean was down by 3.4 percent in 2017. The market is suffering a supply glut in Soybeans along with lower demands from China.

- After rising around 4 percent last year, canola oil was down 2.4 percent in 2017.

- The price of corn is down 2 percent 2017, after rising just 0.28 percent in 2016.

- The price of wheat was down more than 12 percent in 2016, and in 2017, it was up 1.1 percent so far.

- After rising 8 percent in 2016, Oats was up 5.6 percent in 2017.

In 2016, this pack was down 1.6 percent on an average, but in 2017, it was up 3.3 percent.

2018 performance:

So far in 2018, Oats has been the best performer with 11.1 percent gain, followed by Wheat (8 percent), Soybeans (6.3 percent), Canola oil (5.2 percent), Corn (4.8 percent), and Rough Rice (2.5 percent).

So far, this pack has been the best performing commodity class with 6.3 percent gain.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022