China's credit data came in with a disappointment, reflecting the downside risks to the economy. New loans were CNY1.06trn in July (consensus: CNY1.28trn), and new aggregate financing was CNY1.01trn (consensus: CNY1.63trn), with both well below expectations. As the aggregate financing was smaller than new loans, it suggests that the off-balance financing activities were sluggish which is probably related to the recent curb on small and risky financial institutions.

Overall, China's credit growth has been showing a softening momentum since the first quarter of this year, which on one hand suggests a flagging domestic demand and on the other hand reflects a restrained stimulus as the policymakers seem to intend to preserve more bullets to prepare for a prolonged trade war. In the meantime, the recent tightening on property financing should have weighed on the credit extension as well.

While the expectation of the US-China trade turmoil likely to continue to ratchet-up rather than to de-escalate, and our Asian FX Strategists now target USDCNY to reach 7.35 by year-end. Combined with lower targets for EM FX as well as EUR, the broad dollar is now expected to grind 1.8% higher to within a percent of Dec-2016 cycle highs. Recent events confirm that we have entered a collective global policy easing cycle.

During such environment, establishing a pecking order of easing is important to determine FX out- and under-performers, but a look at past collective global easing cycles also highlights USD outperformance. This further underscores that the start of Fed easing does not always portend a dollar downtrend.

Global easing cycles have also historically coincided with a rise in global tensions over macro policy and spillover effects, usually transmitted through currencies, and generally termed “currency wars”. This week we categorize “currency warriors” from “non-combatants” across currencies.

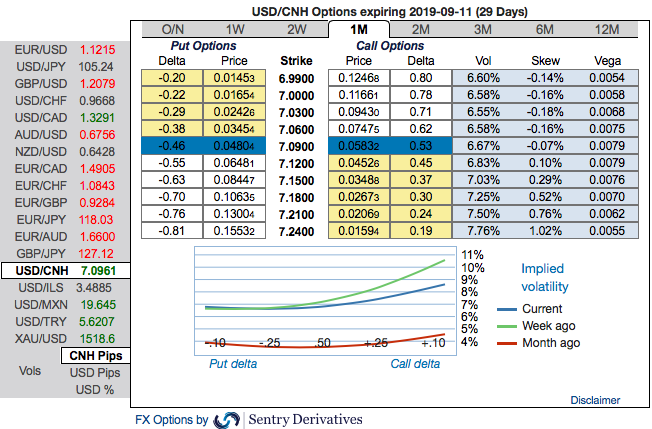

OTC FX updates: You could easily make out that the positively skewed 3m IVs of USDCNH are indicating upside risks, they have been stretched out towards OTM call side. Bids for OTM call strikes up to 7.24 levels are observed (refer above nutshell). This is interpreted as the hedgers’ sentiments are inclined towards upside risks than the downside.

Own vega on the weak side of the CNH riskies for long vol exposure but at smaller decay cost. Alternatively, finance it with short downside front as realized vol is under watchful PBoC hand. Wide 10D – 25D USDCNH call skew poses an opportunity for constructing low cost and high leverage 2M USDCNH topside structures.

Trade tips: Bought 6M 40D (6.76 strikes) USD calls/CNH puts vs sell 1M OTM calls of 7.10. both legs went fruitful including 1m short-side goes worthless. We now like to uphold ITM long positions as the upside risks are foreseen. Courtesy: Sentrix, JPM & Commerzbank

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data