The key determinant of the post-1971 free-floating price for gold has been central bank activity. Simplistically, the impact of central banks on the gold price is two-fold. Indirectly, through their monetary policy decisions, central banks can affect the opportunity cost of holding gold relative to other asset classes but they can also have a more direct impact through their gold buying/selling activities undertaken in the process of managing their FX reserves.

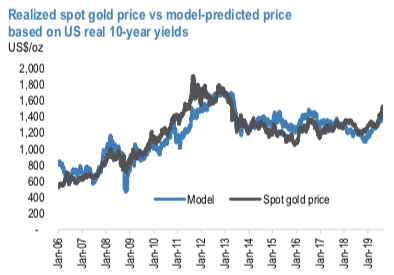

Among central banks, the Fed holds the crown as the most influential factor in the formation of the benchmark USD gold price. Over the last year, even as US 10-year real rates have ranged from more than 115bp to -3bp, the level of US real yields has explained about 3/4 of the variation in USD gold price (refer 1stchart). Similar regressions for 10-year German real yields return a correlation that is about half as strong whereas 10-year Japanese real yields show very little consistent relationship.

Moreover, pertaining to gold, empirical evidence suggests that prices are most sensitive to US policy rates (R2 of 82% since 2006) and less sensitive to the size of the Fed’s balance sheet (R2 of 4%) and buying/selling activities of all central banks combined (R2 of 5%). The rule of thumb suggests that every 25bp move in the US 10-year real yields should result in gold prices moving about $80/oz in the opposite direction. Even more importantly, the same relationship holds between the gold price and the OIS rates market expectations which continue to fundamentally underpin our outlook for gold prices in the future (refer 2ndchart).

Thirteen months into the trade war, we see evidence that major political shocks are turning into economic shocks, depressing global economic growth. The global nature of this slowing calls for a broad policy response. Since the Fed’s dovish pivot in February, other central banks have matched the Fed in action, and willingness to cut earlier and deeper than what we expected and what the traditional indicators might suggest. The dovishness is broad and spans across both EM and DM.

The politics surrounding central banking have also changed, with policy choices now more biased towards easing than tightening, which was the case before. The absence of inflationary pressures globally clearly is one of the reasons behind this change but the rise in populism and overreliance on monetary stimulus to lift global growth have also contributed to this shift. In this altered policy environment, our forecasts are now calling for 19 central banks to ease between now and 3Q20, with policy rates to decline by a GDP-weighted average of 17bp for DM central banks and 39bp for EM central banks.

In the US, along with July’s cut, we see another 25bp easing in September but no additional cuts in 2020. This varies dramatically from what the market is currently pricing, which amounts to more than 114bp of easing through December 2020, or almost five full cuts. In essence, our economists and rates strategists see a much less reactive Fed than the market is currently pricing and as a result forecast that 10-yr US yields will likely rebound towards 2% by the middle of next year, though they do emphasize that downside risks to this forecast have increased recently.

The implications for gold are both critical and massively divergent. J.P. Morgan's projections for increasing US 10Y real yields would imply gold prices moving back down towards $1,330/oz, while the current market expectations would result in an implied gold price between $1,800/oz and $1,900/oz by 2Q’20, depending on the precise beta and inflation expectations applied. Courtesy: JPM

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data