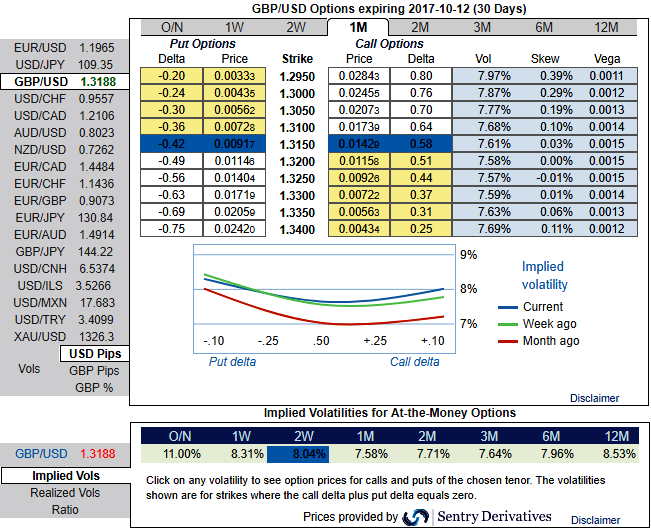

Please be noted that the GBP IVs have been progressively shrinking away.

The cable volatility surface has returned to levels seen at the start of the year overall, while risk reversals have slightly shifted into positive flashes but bearish risks have prevailed on a broader perspective. Please be noted that the 2w ATM puts are priced 16% more than NPV, while IVs of these tenors are shy above 8%, hence, we could foresee this as a disparity.

Consequently, the credit put spreads now seem excessively attractive as the IV skews of 1m tenors are well balanced on either OTM call or put strikes.

GBPUSD is foreseen for a lower high to develop under 1.3270, but the pace of the move through key resistance levels suggests we could retest those highs, if not set a marginal new high. We still view the 1.3250-1.3346 region as significant resistance and ideally the top of a medium-term range. As such, a decline through 1.3120 and then 1.3040/00 supports is needed to suggest a top is developing. JP Morgan has forecasted this underlying pair to hit 1.30 by the year end.

The sell-off in the cable skew is exaggerated compared to ATM volatility since the risk remains asymmetric on the downside, the tail risk is mispriced.

Thus, we advocate initiating shorts in 2w ITM puts with positive theta, and longs in 2m ATM -0.49 delta longs. The execution is achieved at the net credit.

Theta impact:

For a short option position, Theta is positive; time decay is bad for a buyer, good for an option writer.

In the GBPUSD platform’s sensitivity table, Theta is given as an amount in the traded pair’s secondary currency, for an instance, 2W ATM theta here is -27.72 which means on every 1-day completion option value is likely to wipe off by USD 27.72.

Theta is not a constant, it changes as the underlying market moves and time passes.

The Theta of ATM options would be of upper values and is likely to increase as time elapses nearer to maturity. If you are holding an ATM option and expiry is approaching, you might be better off closing out of your position.

Option sellers can reap the benefits of a high Theta near expiry by selling short dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases, likewise the premiums on GBPUSD 1% ITM strikes would have been wiped off along with time decay. Simultaneously, long leg in ATM delta put of longer tenor would arrest potential slumps in the major downtrend.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data