Technical Glimpse:

Although it has taken support at 0.9792 (channel resistance), bullish momentum is not convincing on technical indicators. It is now facing a stiff resistance at 0.9880 levels (i.e. near 7DMA).

Intraday sentiments have been little bullish, while traders on delivery basis should focus on rallies for fresh shorts as the downswings likely prolong if it doesn't hold firmly at current levels and channel resistance.

Buy ATM -0.49 delta put + Sell OTM put option + Sell another deep OTM put option, all contracts with similar expiry.

Economic events:

Given the prevailing economic backdrop, we look ahead for the tomorrow's BoC monetary policy that is likely to stand pat at its current policy stance at April’s meeting as well.

BoC's overnight rates likely to remain at 0.50% with Governor Poloz’s likely to maintain an optimistic tone.

On flip side, Australian unemployment rate is scheduled to be announced tomorrow that is likely to be unchanged. Australia's seasonally adjusted unemployment rate unexpectedly fell to 5.8% in February of 2016 from 6.0% a month earlier and below market forecasts, as the economy added 300 jobs and the number of unemployed decreased by 27,300.

FX Option Strategy: Short Put Ladder (AUDCAD)

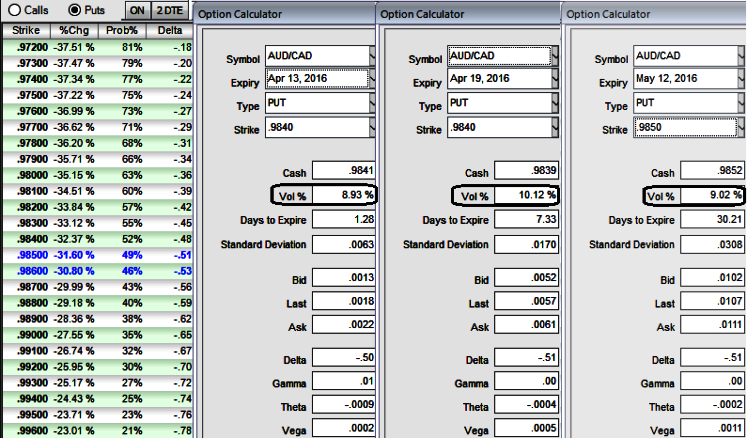

As a result of no much expectations from above economic events, IVs of ATM contracts are stagnantly creeping up from current 8.93% to 10.12% of 1w expiries.

It is again likely to decrease to 9.02% with robust bearish sentiments, thus we focus on this lacklustre IV factor that is favourable for writing opportunities OTM options. Low IV implies the market thinks the price will not move much.

Hence, the recommendation is to deploy "short put ladder spreads" that contains proportionately less number of shorts and more longs which would take care of potential slumps on this pair.

We reckon that for next 2 months time CAD would gain reasonably on account of rising oil prices and stable monetary policy by Canadian central bank.

This would mean that market sentiments for this pair have been bearish for this pair.

So, shorts on ITM put with shorter expiries are advised since implied volatility is not inching higher with raid speed when mild upswings are on the cards, 1w expiry which is good for option writers in mild bullish atmosphere, so the strategy goes this way, go long in 2 lots of ATM and OTM put with longer expiry (per say 2M expiries) and simultaneously short 1W ITM puts with positive theta values.