The European recovery theme has become increasingly mainstream in recent weeks as continued Euro-area growth out-performance intersects with moderating political risks.

Last week, we opened an outright long EURUSD position in covered call format to go with a suite of other bullish Europe expressions (long SEK, CHF).

We list below a few other option-based expressions of Euro strength assuming that French elections deliver a market-friendly outcome:

EUR call flies: Our spot targets for EURUSD if Le Pen loses are relatively benign –in the range of 2-3 cents from current levels since neither positioning metrics nor deviations from high-frequency fair value models suggest that there is much political risk premium in the currency that requires de-pricing.

In addition, EUR options still pack in a reasonable amount of election risk premium despite their recent softening, which will almost certainly disappear after the passage of the event –a key reason to recommend covered calls in lieu of outright cash longs in the FX Markets Weekly macro portfolio.

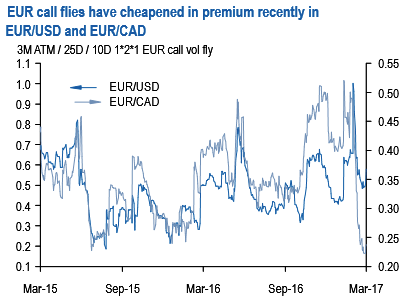

EUR call/USD put flies can be rationalized on similar grounds: there isn’t much skew advantage to selling OTM EUR calls although they have normalized a tad as option-buying interest has picked up recently, but their short vega exposure helps defray part of the negative interest rate carry cost and call flies, on the whole, have become more reasonably priced of late (refer above chart).

Our preference is for RKI flies (RKI on the middle leg) where the trade-off of a few more bps in option premium for materially extended participation in the spot uptrend is an acceptable one. 2M 1.10 –1.12 with 1.14 RKI –1.14 EUR call/USD put flies cost ~30bp EUR (spot ref. 1.0680, max payout ratio 5.7 times if RKI triggered, 11.3 times if not).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data