The macroeconomic data may have improved and headline inflation is on the rise, but these necessary but not sufficient conditions for a more hawkish bias shift at the Bank of Canada will instead probably encounter a patient stance. The rate statement hits the tapes at 10amET on Wednesday along with the Monetary Policy Report and its full set of forecast updates.

Governor Poloz and Senior Deputy Governor Wilkins hold a joint press conference 75 minutes later. Because Fed Chair Yellen speaks twice after the BoC announcements this week, it’s possible that a hawkish sounding Fed will do any of the Bank of Canada’s residual policy work for it on the C$ should the BoC feel the need to retain a cautious but more balanced stance than previously.

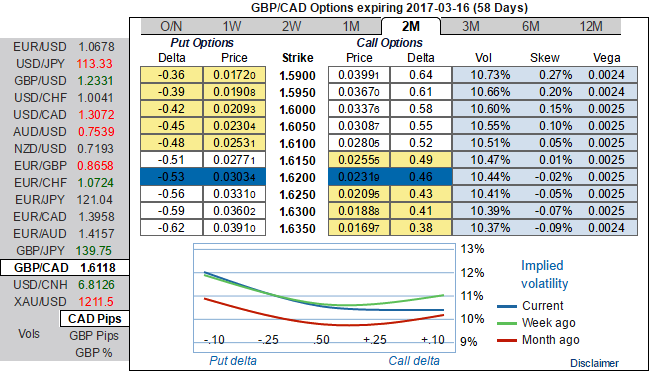

OTC updates and hedging framework:

The main reason behind this decision is that the BoE would not want to add any extra strain on the markets and the British economy in conjunction with the Brexit apprehensions by allowing any speculation about an adjustment of its monetary policy.

In OTC markets, ATM IVs seem to be quite on the edge to factor in the weakness in this pair as we could see reasonable increase in IVs of 2W and 1M tenors. As a result, we recommend capitalizing on the sustainable IV factor by employing ITM short puts as there central bank's decision was also in line with market's expectations and matching this with ATM longs to construct short term back spreads that is likely to fetch positive cash flows as per the indications by sensitivity table.

When trying to assess how a spread may perform, looking at the 2m IV skews spreads of deeper in the money option shorts for an indication of relative option prices.

So, keeping all these attributes in mind, here goes the strategy, go long in 1M 2 lots of ATM -0.50 delta put, and in 2M (1%) OTM -0.36 delta puts, while shorting 1 lot of ITM put (0.5%) put with 2-week expiries.

Subsequently, the slight upward or sideway swings would derive the positive cashflows through the initial receipts of shorts which could be utilized for reducing hedging cost.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady