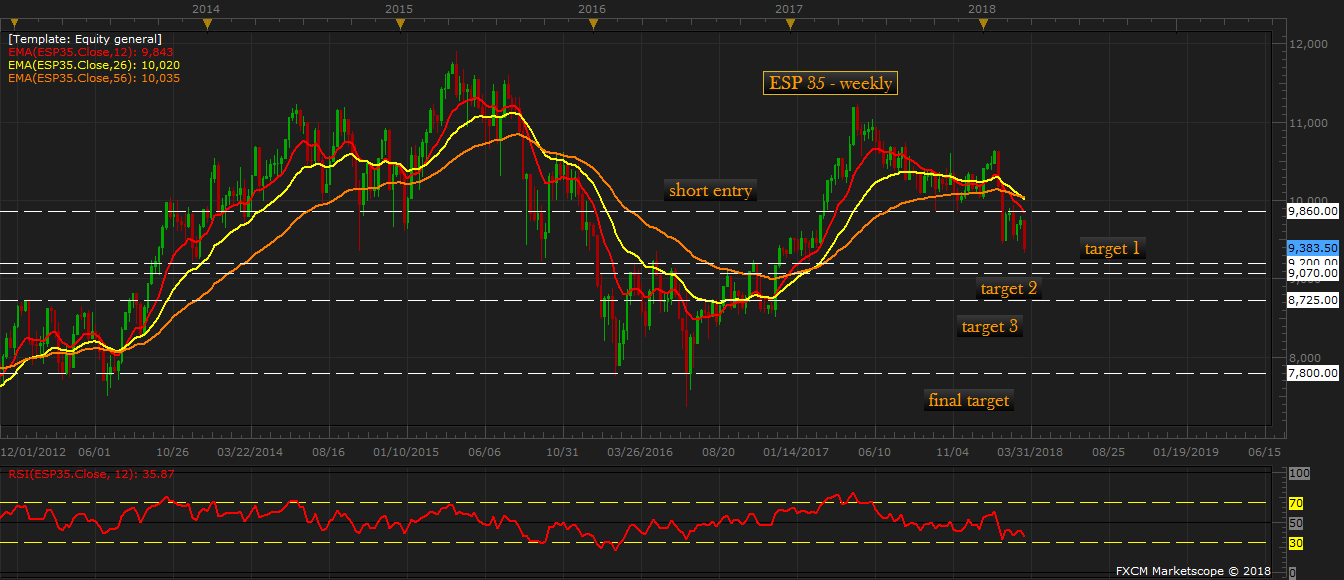

Back in February this year, in an article named, “FxWirePro: Sell IBEX35 targeting 7800 area”, available at https://www.econotimes.com/FxWirePro-Sell-IBEX35-targeting-7800-area-1158558 , we suggested, “We at FxWirePro believe that the global stock markets selloff that rattled investors’ nerves for two weeks might not be over, at least for the European stock markets. While the U.S. stock markets can enjoy the support of recently passed tax cuts and reforms, the European bourses lack such.” We also highlighted our bearish calls on several European indices, namely Eurostoxx50, DAX, FTSE100, and CAC40 and we urged our readers,

“Our calculations suggest that the benchmark, which is currently trading at 9860 (ESP35) is likely to decline towards 7800 area. The stop loss for this trade should be maintained at 10680, which is 820 points from the current price.”

Since then, IBEX35/ESP35 has declined further and most recently due to trade tensions. President Trump in early March announced 25 percent tariffs on all Steel imports and 10 percent tariffs on Aluminum imports. This week, Trump announced a trade action under section 301 which targets Chinese goods worth $60 billion which will become live after a 30-day period.

As global stocks selloff fathers pace, SP35 (CFD of IBEX35) declined further and currently trading at 9390 area. We would like to urge our readers to maintain short positions and in this article, we would like to add the following interim targets.

Target 1 - 9200

Target 2 - 9070

Target 3 - 8725

Expect temporary bounce backs from the above-mentioned interim a targets. Readers can go for partial profit bookings at their own discretion.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX