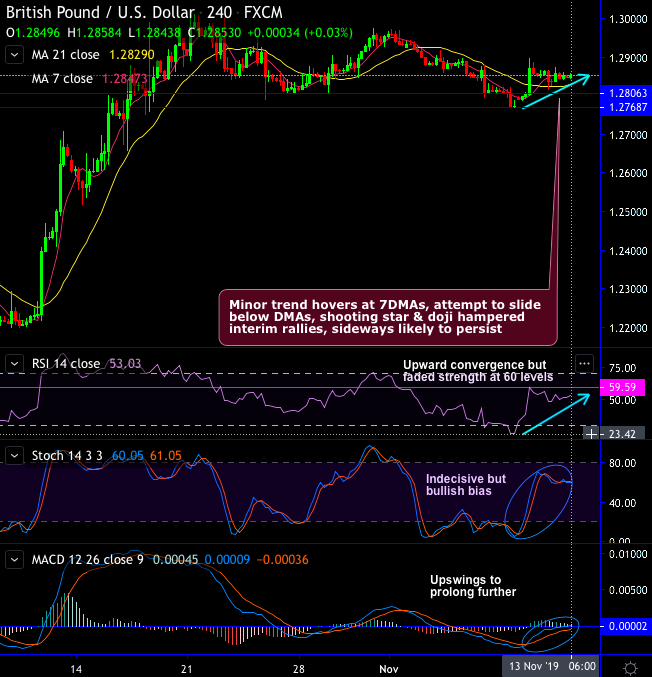

Cable’s (GBPUSD) minor trend is attempting to bounce but drifts in a 1.2875 - 1.2825 range. While over 1.2768 support, we foresee upside traction but divergence developing in the daily studies warns that the upside is limited in the short term.

But, the pair appears to be showing resistance in a narrow range, the sideway trend seems to be most likely to persist.

As such, in the run up to the general election, we are inclined for a 1.2650-1.3075 type range to develop in medium term. A clear break and close above 1.3064 (i.e. around 100-EMAs) would expose us to allow for a test closer towards the medium-term 1.3400 range highs, while a break below 1.2650 would risk a deeper setback towards 1.2300-1.2200 again.

On a broader perspective, bulls, in the major trend, managed to break-out triangle resistance. But still, the major downtrend remains below 100-EMAs despite interim rallies, upswings may extend but 100-EMAs major hurdle.

the major trend bias is that 1.1490 was a major low, but a break below 1.1950 would question that and probably see those supports re-tested. A move back above 1.34 supports our analysis, with 1.40-1.45 key long-term resistance above.

Overall, although the buying sentiments in sterling are round the corner that is engulfed with the overbought pressures and the major downtrend sentiments as well.

Trading and hedging tips: At spot reference: 1.2848 levels, on trading perspective, contemplating above technical rationale, it is advisable to execute boundary spread options strategy with upper strikes at 1.2875 and lower strikes at 1.2825 levels, thereby, one can achieve certain yields as long as the underlying spot FX remains between these two strikes on the expiration.

Alternatively, on medium term hedging grounds we advise to maintain short positions in futures contracts of mid-month tenors. The writers of the futures contract are expected to maintain margins in order to open and maintain a short futures position.