We have been already reiterating from months ago, the risk bias to Antipodean currencies remains firmly to the downside during H1 2016.

Since, Australia being the largest trade partner with China, the prospect of lower Chinese growth and weaker commodity prices, and the intensifying EM deleveraging process are all conceivable headwinds to both AUD and NZD in the year ahead.

Australia reported a trade gap of AUD 3.54 billion in December of 2015, an increase of 30 percent from a downwardly revised AUD 2.73 billion deficit in a month earlier and missing market expectations. It is the largest deficit since June last year as exports fell more than imports.

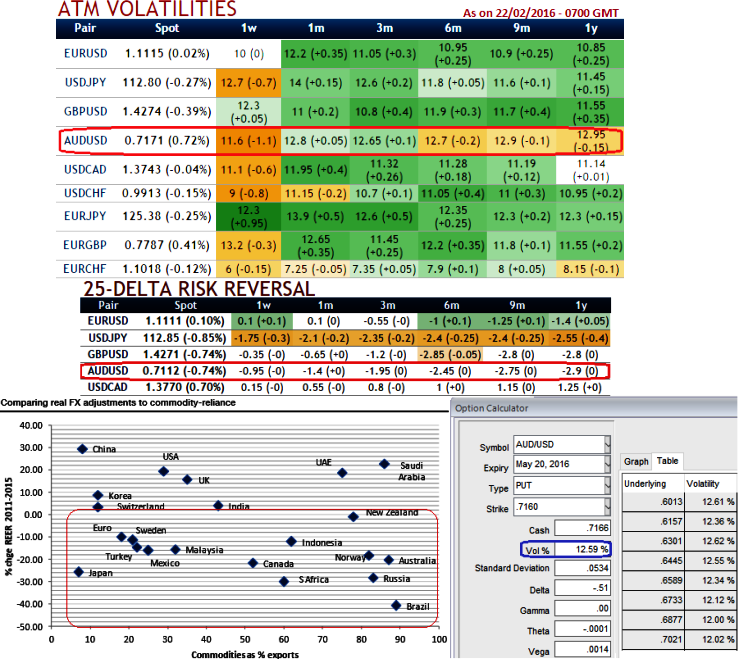

As we could observe from the diagram, AUD/USD 3m vols are retreated lower along with risk reversal piling up for downside risks, this would mainly due to the CNY vol sell-off.

Yuan volatility has been pressured by the New Year break and the subsequent respite in the currency decline. But downside risks related to capital outflows from China persist.

Base case (65% probability): controlled depreciation in USD/CNY 6.80 by end-2016.

Risk scenario (35% probability): slow, fast or abrupt to USD/CNY 7.50 by end-2016, well overall CNY to losing streak to persist in this year.

The PBoC must tighten capital controls to slow down the depletion rate of FX reserves. If capital controls fail, the most likely risk scenario is a move to free float before year-end.

On the other hand, AUD will be the biggest looser when the CNY downside returns, as a result we could foresee AUD/USD to retest the recent lows of 0.69 and 2008 lows of 0.60 if disorderly move to USD/CNY 7.50; 0.55 and if RBA cuts in the next monetary policy sessions.

Apparently, on a cross currency effects, if AUD/NZD falls to roughly 1.0, NZD/USD should slide to 0.55-0.6.

Trade and Hedging Recommendation:

Owning USD/CNH call spreads preferred to vanilla calls or long USD/CNH, Long CNY NDF against TWD or KRW on attractive carry, alternatively, one can eye on longs in USD/KRW or long USD/TWD as lower negative carry proxy trades.

FxWirePro: CNY struggle to weigh on AUD/USD volatility - AUD and CNY trade and hedging perspectives

Monday, February 22, 2016 8:12 AM UTC

Editor's Picks

- Market Data

Most Popular