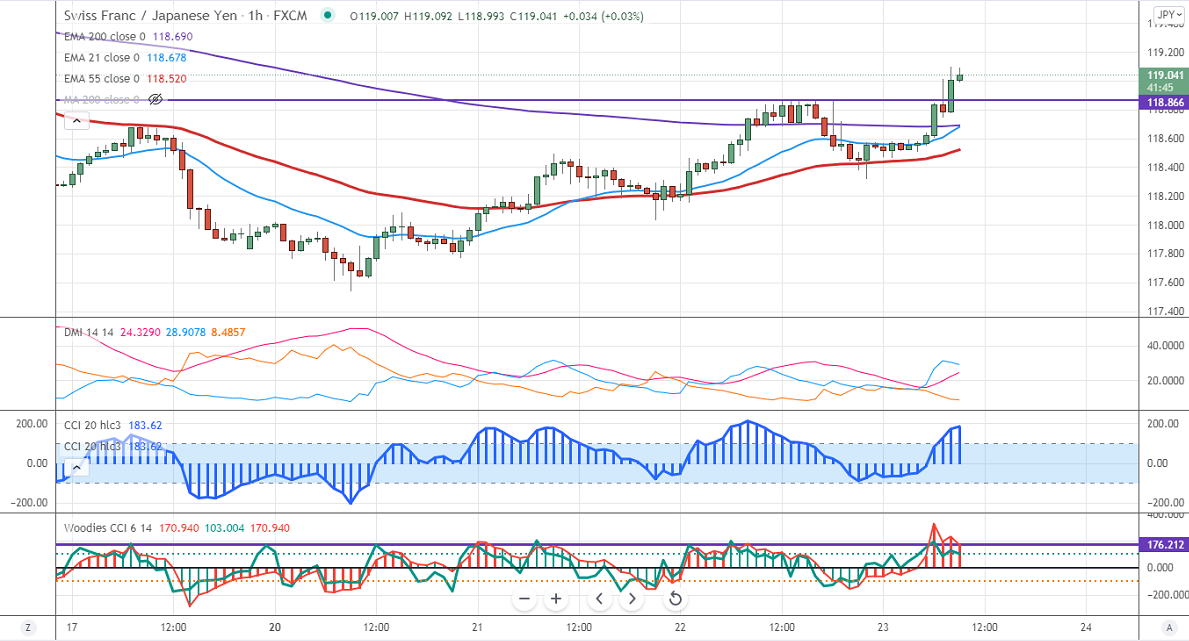

Major Intraday resistance -119.20

Intraday support- 118.30

CHFJPY surged sharply after hitting a low of 118 on board-based Swiss franc buying. The global financial markets turmoil due to the Chinese Evergrande debt crisis has increase demand for Safe-haven like the Swiss franc. It hits an intraday high of 119.08 and is currently trading around 118.97.

CCI and Woodies CCI analysis-

Both CCI (50) and Woodies CCI is above zero lines (bullish trend)

In Woodies CCI six consecutive bars should be above zero to confirm a bullish trend (only 4 bars above zero line.

Technically, near-term support is around 118.69 and any indicative break below will drag the pair down till 118.30/118/117.54/117.

The immediate resistance is at 119.20, any convincing break targets 119.60/120.

It is good to buy on dips around 118.80 with SL around 118.30 for the TP of 120.