In the options space, CAD volatility remains stuck at the lows, and we identify an appealing skew opportunity.

After the Canadian dollar’s sharp rise this year, USDCAD risk reversals have been under heavy pressure, reaching their lowest level since 2009 (refer above chart).

This makes CAD puts historically cheap, with a 3m skew that is almost flat. Interestingly, the USDCAD skew has evolved in line with the skew of Brent options, but they disconnected recently.

Oil puts remain expensive compared to cheaper CAD puts.

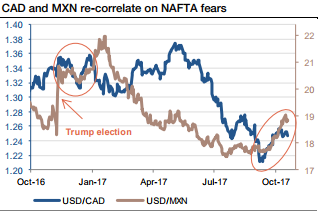

Oil downside risks could pressure CAD further, the US has made difficult demands in the NAFTA negotiations with Canada and Mexico. With growing concerns about NAFTA's future, weakness in both the MXN and CAD is extending, with these currencies tending to re-correlate when the market focuses on trade agreement risk, like after Trump’s election and more recently (refer above chart).

Oil price developments should remain marginal and secondary to relative monetary repricing, especially since our (recently marginally upgraded) forecasts envision WTI crude to remain within a $40-50/bbl range (we have earlier pointed out that only sustainably below $30 or above $60 would there be more substantial and less linear negative or positive impacts to the economy and currency).

Our EM strategists recommended short ZAR/MXN but reckon that still-bullish MXN positioning, coupled with NAFTA uncertainty, may limit MXN gains.

According to the CFTC, CAD long positions spiked this summer to reach their highest level in five years, suggesting unwind risk on revived tensions and the likely BoC status quo next week.

Oil prices are near the top of their two-year range, so we think that investors should favor hedging further CAD weakness given oil downside risks. BoC expectations should no longer boost the CAD, with a hike in 1Q’18 already mostly priced in, plus another hike by end-2018.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios