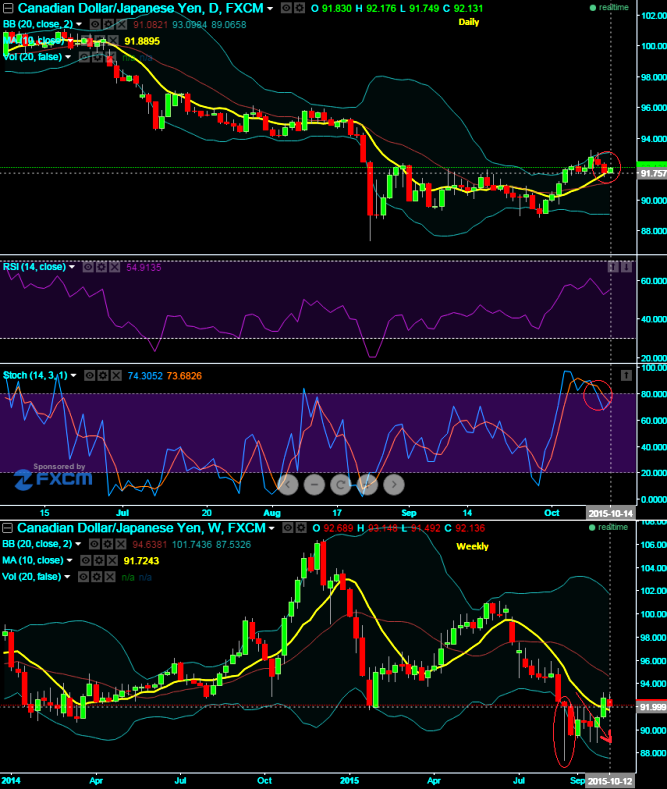

Lot of puzzling has been happening in CADJPY when we consider the intermediate trend of this pair, bullish candles such as dragonfly doji at 92.160 on weekly has been unable to prop up prices effectively although bulls have shown little buying interest, on the contrary leading indicators on the daily charts have started diverging the current upswings that would still suggest the previous downtrend trend to prevail.

Weekly RSI has started diverging with price spikes near 45 level (Currently, RSI at 40.7121), while slow stochastic is also stating indecisiveness and we observe %D line crossover above 80 levels on daily terms that generates selling pressure at this point of time.

The current prices on both daily and weekly charts remained well above moving average curve but attempting to crossover which is puzzling long term bearish sentiments. So this week's closing figures would give us clear picture for next trend in this pair.

As there is intraday buying trend is on, with positive technical indications, we see buying opportunities in binary calls for a targets to reach at 92.233 levels and even above.

Contemplating intraday bull sentiments, we recommend on pure speculation basis buying one touch binary calls in order to extract maximum leverage for extended profitability. By employing At-The-Money binary delta calls one can multiply returns by twice, thrice or even pour returns exponentially. But do remember these are exclusively for speculative basis.

FxWirePro: CAD/JPY intermediate trend to puzzle – opportunity for swing traders to buy binary calls for TP at 92.233

Wednesday, October 14, 2015 12:28 PM UTC

Editor's Picks

- Market Data

Most Popular