Bullish CADJPY scenarios driven by:

Global crude oil prices still rise sustainably above $65.50/bbl triggering a renewed investment cycle

BoC hikes 25 bps

The BoJ does not move even if core inflation rate rises more than expected

Bearish CADJPY scenarios driven by:

NAFTA renegotiations break down and breakup fears return

BoC does not hike

US growth expectations upgraded on policy driving a broad $ rebound

Severe deterioration of US politics and geopolitics dent US growth expectations and further widen out the broad dollar discount much further.

CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads. But any recovery in crude oil prices may cushion CAD in the upcoming days.

OTC Updates and Options Strategy:

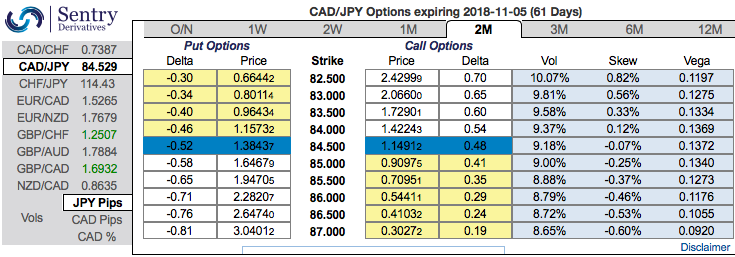

Well, aforementioned bearish driving forces seem to be factored-in OTC hedging sentiments, please be noted that the positively skewed ATM IVs of 2m tenors indicate the hedging interests of OTM put strikes upto 82.500 levels, IVs of these tenors are trending between at 8.68%-10.11%.

Contemplating all these driving forces of CADJPY, we reckon that the underlying pair has equal chances of moving on either side but with more potential on the downside, accordingly, we advocate diagonal options strips strategy on both hedging as well as trading grounds.

As the major downtrend has gone in consolidation phase since December 2015 (refer monthly plotting for range-bounded trend), accordingly, initiate longs in 2 lots of 1m ATM -0.49 delta puts, simultaneously, add long in 1 lot of ATM +0.51 delta call of 1m expiry, the payoff function of the strategy is likely to derive positive cashflows regardless of swings but more potential from the underlying spot FX moves towards the downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -136 levels (bearish), while hourly JPY spot index was at 56 (bullish) while articulating (at 08:44 GMT). For more details on the index, please refer below weblink:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays