January GDP surprised to the upside; we raise our 1Q forecast to 3.8% SAAR.

The small business sentiment held at solid levels.

But there remains a little sign of wage or inflation pressure despite recent employment gains.

We introduce a Bank of Canada rate hike forecast for 3Q18 but would need to see a shift in tone to move it forward.

Despite a strong run of Canadian data, the Bank of Canada has retained a dovish tone in its communications in recent months.

This week continued that pattern, with Governor Poloz reiterating his belief that the Canadian output gap remains large, but January GDP subsequently surprised strongly to the upside.

Our nowcaster now looks for 4.8% SAAR GDP growth in 1Q; we raise our forecast to a more cautious — but still robust - 3.8%.

With this robust growth and the unemployment rate now just a tick above our estimate of its natural rate, we continue to believe that the Canadian output gap is likely smaller than the Bank of Canada thinks. In our view, some of the declines in GDP driven by the decline in oil mining activity represents a permanent loss of productivity and thus a decline in the level of potential output. But the Bank appears to believe that levels of productivity and potential GDP should be able to catch up to their trend from before the oil price decline, despite the permanent loss of high-productivity mining jobs.

And, in fact, data on wages and inflation continue to support the Bank’s case for a large output gap, as there has thus far been little sign of acceleration in either.

To this point, our outlook had left the Bank on hold through our 2018 forecast horizon. With the recent improvement in the data, we now introduce a 25bp rate hike in our forecast for 3Q18.

Given the robust pace of GDP growth and improvement in the labor market, it is a natural question why a hike should not come even sooner than that.

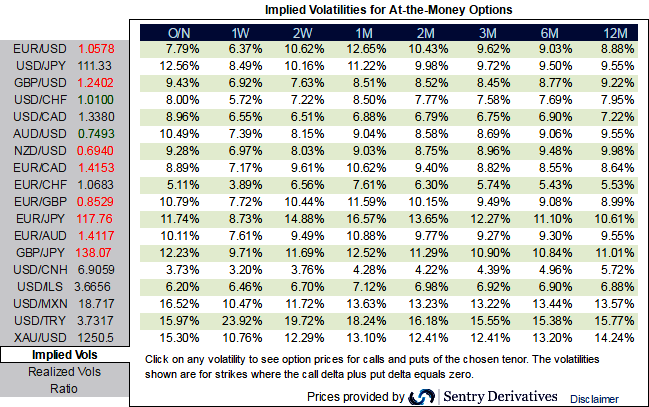

Please be noted that the considerable shrink in CAD implied volatility of ATM contracts across all tenors.

ATM IVs of this pair fading below 7% across all tenors despite BoC’s monetary policy meeting that is scheduled to be announced on 12th April, the tepid IVs among G10 FX space appear to be conducive for option writers that optimize hedging arrangements over the period of time.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis