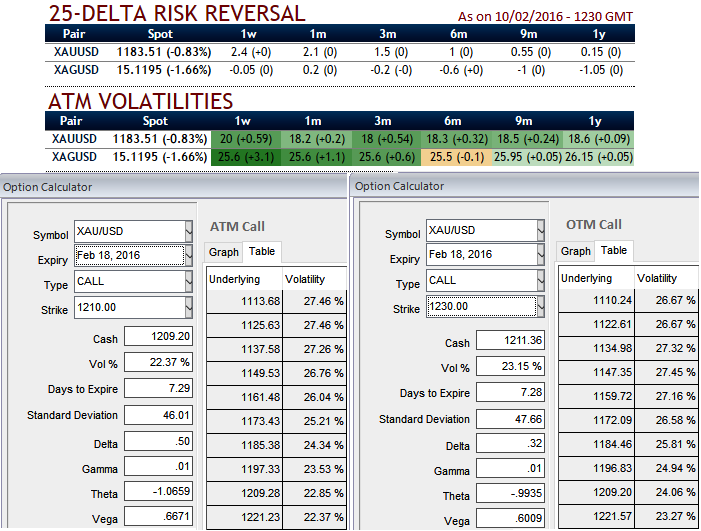

With gold CFDs flashing at 1207.00 we see delta risk reversal for 1W-1M contracts have shown higher positive numbers that signal upside risks in this commodity next 1W-1M call options are on higher demand. As you can make out from the nutshell showing XAUUSD still maintains above +2 delta risk reversals but reducing in 1 month expiries with spiking implied volatility, almost at 18-20%.

As a reminder, this higher IV represents how much movement today's spot market expects from this commodity and the life span of the options contracts. In that respect, an option buyer is partially buying the market's expectations for this pair.

More importantly, the contracts of this pair for 3m-6m expiries also show positive flashes that means unchanged OTC sentiments even in long run. So, from this computation what we could read is that EUR may gain until Fed's rate decision and thereafter we could foresee dollar's appreciation as quite certain event. But technicals have all different opinions in near future. So if you don't want to take any chances and play it safe, one can prefer below hedging strategy that is likely to block in irrespective of the swings.

Strategic Hedging of Gold:

We recommend it is better to own open positions as shown in the diagram purchase 1 ATM call and (1%) OTM call and simultaneously short 1 lots of ITM call with shorter expiry in the ratio of 2:1.

The lower strike short calls because of two major reasons,

Firstly, on technical perspectives there were some overbought scenes prompted by leading oscillators coupled with some other bearish indications and no surprises even if it falls in abrupt as we want to capitalize on these dips, secondly, it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose 1% OTM calls as well) and the position is entered for no cost or a net credit.

The current IV of XAUUSD call is at 22% which is extremely higher side, usually if the Vega of a long option position is positive and the implied volatility rises or dips, the above stated option prices are directly proportional to the implied volatility.

So in this case Vega both on long position is reasonably acceptable. It is desirable that at maturity the underlying exchange rate of XAUUSD to remain near short strikes in order to achieve highest returns.

FxWirePro: Buy risk reversals and hedge with back spreads as Gold shining to upside risks

Thursday, February 11, 2016 8:22 AM UTC

Editor's Picks

- Market Data

Most Popular