Beyond the unwind of the earlier premium versus a heavily broadly discounted dollar as discussed earlier, the other major driver of the 7% trough-to-peak backup in USDCAD in 1Q was the divergence of policy pricing between the Fed and the BoC, wherein US-CA 2y swap spreads widened by as much as 28bps between early Feb and late March, which on our model would have been worth half of the 7% backup in USDCAD.

As with CAD risk premium as discussed above, there are other plausible reasons for a pricing in of a relatively more dovish BoC, including the run of negative data surprises in 1Q. But it is hard to divorce NAFTA risks from the BoC pricing outlook, particularly given that it has been part of BoC’s framework and rhetoric for the past year, particularly since October.

Meanwhile, despite recent data surprises, our economist have not changed their expectations for 4 BoC hikes this year, in-line with the Fed, given ongoing indications that inflation is at/above target and capacity is tight even in light of some near-term softening in activity.

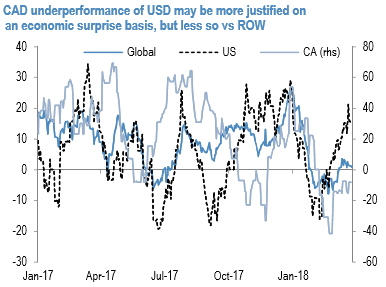

Finally, while the widening of US-CA rate spreads might be more justified given relative US-CA data surprises, the recent evolution in the data has been less differentiated versus rest-of-world economies, which again point to the recent relative underperformance of CAD on the crosses more compelling to fade (refer above chart).

We think there is medium-term value in fading the wide CAD underperformance and discount that has opened up recently versus peers, which in our baseline is not justified by relative monetary policy (4 BoC hikes this year), nor trade risk (no NAFTA crash-out). The potential near-term NAFTA break-through is a potential catalyst for the recent retracement of this underperformance to run significantly further. Therefore we buy CADJPY (bought at 85.195, stop at 83.0590) as a best risk-reward expression of CAD underperformance reversal.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis