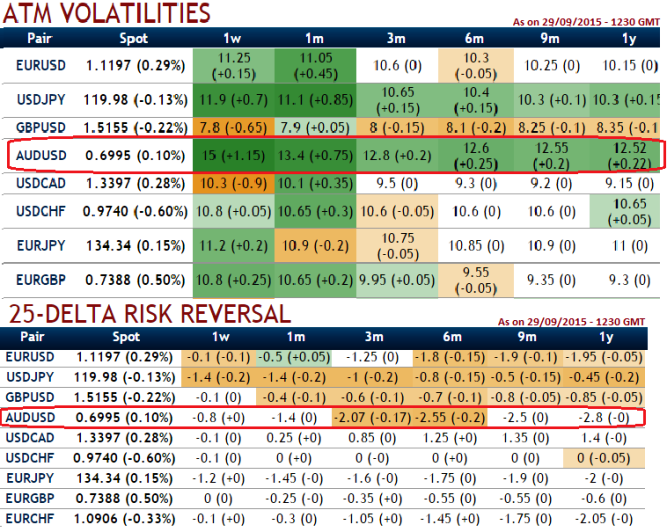

With spot FX flashes of AUDUSD at 0.6995 we see delta risk reversal for 1 week contracts have shown slight recovery signals but long term (1M-1Y) put contracts are on higher demand. As you can make out from the nutshell showing AUDUSD still maintains the highest implied volatility of 1W at the money contracts among G20 currency pool, almost at 15%.

As a reminder, this higher IV represents how much movement today's FX market expects from AUDUSD during US sessions and the life span of the option. In that respect, an option buyer is partially buying the market's expectations for this pair.

Comparing these two factors and synthesizing while projecting the trend we understood the following fact. In foreign exchange (FX) market prices move to extremes more frequently and these extreme levels is referred to as "Fat Tails". If more price actions occur at the fat tails, the option trader will mark volatility higher for out-of-money (OTM) and in-the-money (ITM) options then at-the-money (ATM) options and so does happen with AUDUSD pair currently. If there is no downside bias in market expectations of the underlying price then the price of volatility is symmetrical around ATM options.

AUD/USD Put Ratio Back Spread:

One can now set up AUDUSD put ratio back spread regardless of upswings by improving odds in its positions as explained below. That In-The-Money puts on short side in put ratio back-spreads are always at risk of exercise if the market tumbles, but you have two advantages.

Firstly, keeping maximum tenor on long side: Giving a longer time to expiration for long sides, any abrupt drastic moves on the downside so that assignment can be covered by the long puts. Secondly, time decay advantage: Using near month contracts or contracts shorter tenor on short side signifies the importance of entering the position when IV is lower than average but AUDJPY IV is seen at 10% which is quite higher side (due to data season), so let us keep maturity on short side as normal as near month contract period. Time decay and implied volatility work in your favor on the short puts.

FxWirePro: Buy AUD/USD risk reversal on higher IV – PRBS for hedging

Wednesday, September 30, 2015 7:11 AM UTC

Editor's Picks

- Market Data

Most Popular