The price of precious yellow metal (in the bullion market) gains considerably from the last couple of days, currently, exhausted at $1,747 and oscillating between $1,700 and $1,728 levels.

Multi-week slowdowns in COVID-19 infection rates and fatalities are adding to the broadest,

largest and earliest monetary/fiscal stimulus programs in history.

As Covid-19 started to invoke fears of a dollar liquidity crunch, gold became a ripe candidate for a selloff. The need for dollars from both within and outside the finance sector arose. Heavily stressed sectors like airlines and hospitality reportedly sought to draw down credit lines as they tried to maintain operations. The finance industry, whipped by volatility, margin calls and financing needs, also started to demand more dollars.

Hence, Gold became a prime target for a selloff if not in long run at least momentarily. As gold was a highly liquid asset and was one of the few markets still posting year-to-date gains, investors reportedly sold off gold to raise cash.

To begin this week, the price gains have been pared with profit booking sentiments. There were traces that investors remain highly cautious amid the prevailing pandemic circumstance.

Gold prices surged to their highest level in more than seven years as the spectre of a deepening global recession continues to support safe haven buying. Spreads between futures and spot prices also remain wide, suggesting liquidity remains tight. The latest wave of buying was sparked by the announcement last week that the Fed will invest up to USD2.3trn in loans to aid small and medium sized business.

OTC Updates:

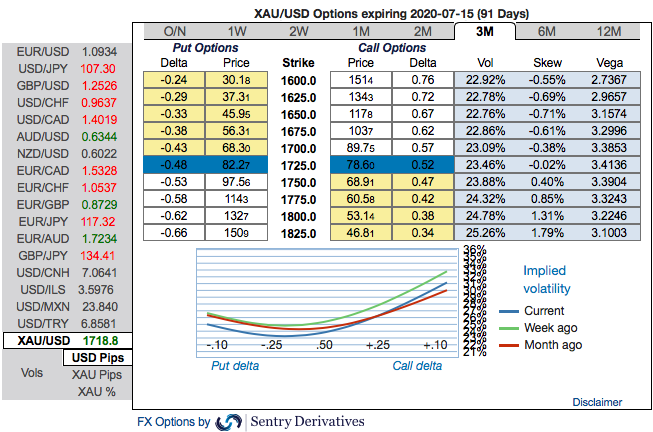

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,825 is quite evident that reminds us hedgers’ inclination for the upside risks.

One could also see the fresh positive bids for the existing bullish risk reversal setup. To substantiate the above-mentioned bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2nd nutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future.

Hedging Strategies:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry & Saxobank

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different