Bearish GBP scenarios:

1) Growth slows below 1% as consumers are squeezed by inflation and falling house prices.

2) Outright capital repatriation from slower moving long-term investors including central banks.

3) Initial Brexit talks flounder on the size of the UK's exit-bill.

Bullish GBP scenarios:

1) The govt pursues a lengthy transitional deal with the EU which maintains the trade status quo for 2-3 years.

2) The economy rebounds to 2.0-2.5%.

3) 2-3 MPC members dissent for tighter policy at the Aug MPC/QIR.

4) Current a/c deficit shrinks below 2%.

Bearish JPY scenarios:

2) Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations.

Bullish JPY scenarios:

1) The global investors’ risk aversion heightens significantly,

2) Weak US economy dampens hopes for Fed hikes and leads broad USD weakness.

Technically, GBPJPY rallies seem likely to extend further on bullish DMA crossover but the major trend still edgy.

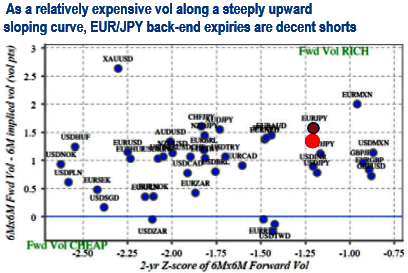

Back-end EURJPY vols are decent shorts outright or in spreads against GBPJPY to play the correlation upturn; the latter is an RV efficient way of assuming exposure to Brexit risks.

For those willing to countenance outright vol shorts, expensive back-end vols on steep vol curves of relatively lower-beta yen-crosses such as EURJPY appear to be decent targets (refer above chart); this also meshes with the previous theme of a period of quiet on Euro crosses.

We favor a more defensive variation of this in the form of GBPJPY - EURJPY vol spreads that are positively correlated to EURGBP vol outright but enjoy a more favorable implied -realized vol set-up (refer above chart).

They are best traded in longer tenors (1Y -2Y) as liquidity permits in order to assume maximum exposure to speedbumps along the long Brexit negotiations road, and in modestly OTM JPY calls strikes (35D downsides) to take on GBP skew risk funded with EUR.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into -57 (which is mildly bearish), while hourly JPY spot index was at shy above -150 (highly bearish) at 06:07 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?