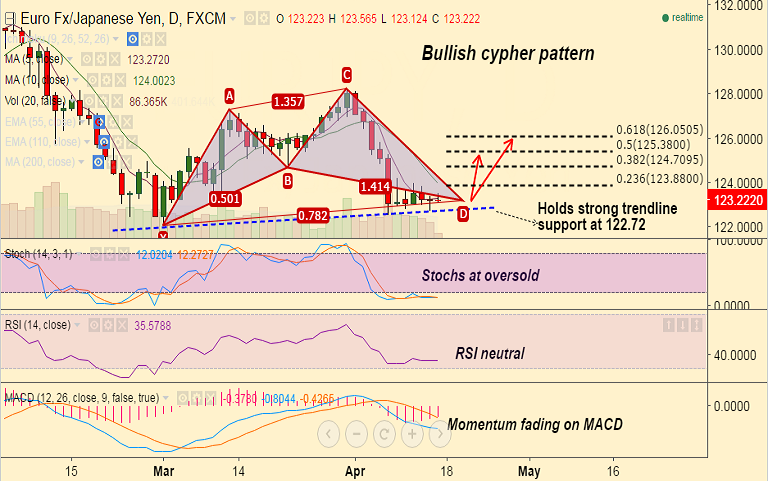

- A Bullish Cypher pattern completed on EUR/JPY daily charts. We see weakness only below 122 levels.

- The pair has also taken strong trendline support at 122.72 on Thursday's trade.

- Scope for upside test of 125.38 (50% Fib retrace of 128.221 to 122.539 fall) and further bullishness could see 126 levels (61.8% Fib retrace of 128.221 to 122.539 fall).

- Stochs on daily charts are at oversold levels and downside momentum on MACD is fading.

Recommendation: Good to go long at dips around 123 levels, SL: 122, TP: 124/124.70/125.30