The CNY FX has started its celebration of the Chinese New Year early this year with a decent dip of the USDCNY pair towards the 6.92 - 6.93 handle while the CFETS TWI has rallied by an impressive 0.8% YTD.

On the back of its outperformance amid recent swings in risk sentiment and rising concerns over global geopolitical uncertainties, we note constructive equity inflows and suspected pickup in seasonal corporate dollar selling before the Lunar New Year as supportive factors.

The near-term outlook for the CNY FX is arguably a constructive one as the supportive factors outlined above are not easy to fade and the corporate dollar selling is expected to continue until the Chinese New Year. In a sense, the risks around the forecast bias in the short-run are skewed to the downside, meaning the USDCNY pair could sit comfortably below our 1Q forecast at 6.98.

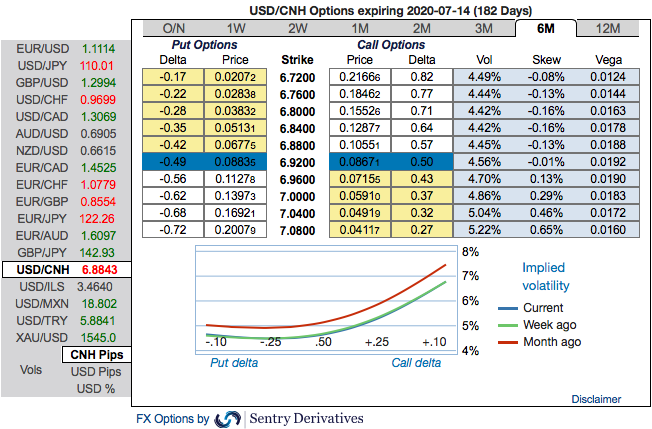

Accordingly, we are positioned for any risks of lower USDCNY with 2M (14-Feb-20 expiry) 6.80 strike at-expiry digital USD put/CNH call.

With that said, our view on the CNY FX over the medium term remains a cautious one given limited prospects of a long-lasting trade truce coupled with domestic capital flow pressures.

CNY Bearish Scenarios:

1) Trade conflict with the US re-escalates;

2) Rebound in domestic growth is slower than expected;

CNY Bullish Scenarios:

1) Fiscal stimulus is stronger than expected;

2) Portfolio inflows strengthen further ;

OTC Outlook & Hedging Strategy:

Please be informed that the positively skewed IVs of 6m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.08 levels.

Contemplating above factors, and organic depreciation pressures likely will take the pair back higher in 2H as domestic growth is expected to moderate and likelihood of further trade deals become difficult with the U.S. election cycle kicks in. Without any meaningful surprise to the scale of tariff rollback down the road, we struggle to see the case for the USDCNY to sustain notably lower than its current tariff neutral range at 6.95-7.20.

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 5-month (7.00/7.15) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry & JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data