Gold price consolidation, so far in this year, has struggled amidst the market’s hawkish reconsideration of Fed policy as to how robust the growth and low unemployment have been, and the by-product of this policy amidst growth letting up in the rest of the world – a rallying dollar. A rising US yield curve has also been a dominant issue affecting markets this year. Gold futures for December delivery GCZ8, inched higher today, up about +0.39% on Comex rose $4.79, or 0.5%, to $1,226.12 an ounce, while December silver SIZ8, +1.08% was up 15.6 cents to $14.473 an ounce.

OTC Outlook and Options Strategies:

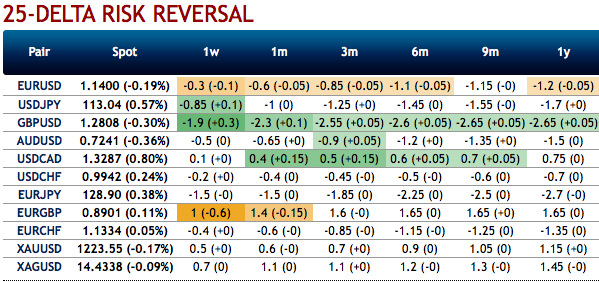

Bullish neutral risk reversals are observed in gold’s OTC hedging market, while positively skewed IVs of 1m XAUUSD options have been stretched out on either side. This is interpreted as the hedgers bid for both OTM calls and OTM put options.

On hedging grounds, keeping above seesaw hedging sentiments under consideration, ATM straddles are advocated, while the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 1m tenors at net debit with a view of arresting potential FX risks on either side.

On trading perspective, bidding bullish neutral risk reversals, buying (1%) in the money gold call options are advocated, an in the money call with a very strong delta would move in tandem with the underlying XAUUSD move.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 1 levels (which is bearish), while articulating (at 14:16 GMT). For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts