We forecast a moderately higher gold price during the remainder of the year with a 4Q16 price forecast of $1,350/oz as our economists expect a slow pace of Fed tightening with the next rate hike likely at the December meeting.

Having said that, one should acknowledge the downside risk from very long investor and speculative positioning, which could at some stage cause some selling pressure. In addition, physical demand from key Asian consumers has remained stubbornly weak this year.

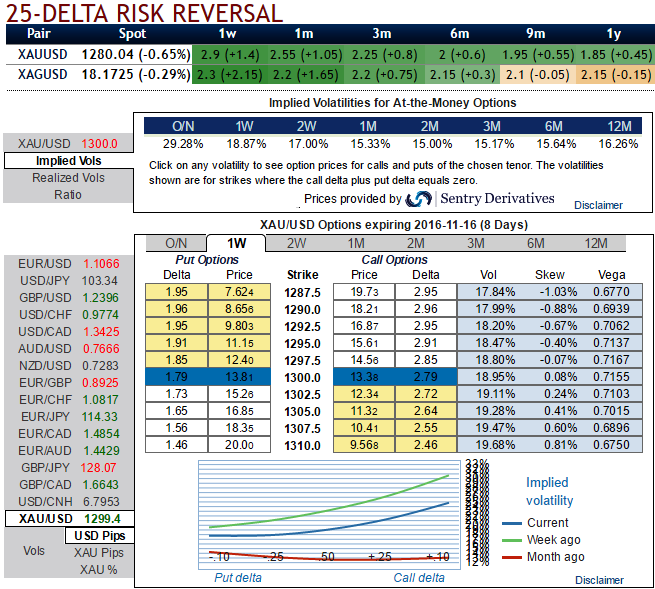

Please be noted that the implied volatilities of 1W XAUUSD ATM contracts are spiking eccentrically above 18.75% for 1w tenors.

While rising positive risk reversal flashes are still signaling upside risks with positively skewed 1w IVs, considering above fundamental developments in bullion markets we think the opportunity lies in writing an OTM put while formulating below strategy for gold's fluctuation at this juncture.

3-Way Options straddle versus Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Bidding short term risk reversals with writing 1W OTM put contracts,

After Trumps shocking victory the bullion market may gain momentum on safe-haven demand sentiment.

So, with favoring current uptrend of this precious metal shorting, writing exorbitantly priced puts with shorter expiries would reduce the cost of ATM straddles.

How to execute:

Go long in XAU/USD 2w at the money delta put, long in 4w at the money delta call and simultaneously, Short 1w (1%) out of the money put with positive theta.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025