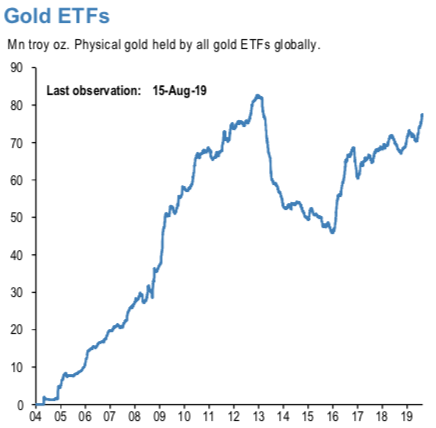

Gold’s gaining its traction a safe-haven sentiment, with inflows into ETFs (exchange-traded funds) hitting 1,000 tons since holdings bottomed in early 2016 after a prolonged unwind in the wake of the global financial crisis (refer 1st chart). While CFTC’s speculative positions in gold have also risen considerably (refer 2nd chart), please be noted that the rising curve indicates the net longs in CFTC gold’s futures.

Well, yesterday, the total ETF holdings surged to 2,424.9 tons, the highest since 2013. Price of the precious yellow metal has constantly been gaining this year (gained about 15.72% since this May) as apprehensive investors are worried for the prevailing global slowdown and need safeguarding from the same, the relentless trade turmoil, geopolitical issues like Brexit, NAFTA etc and struggle in the bond market are indicating the U.S. is most likely headed for another recessionary phase.

Technically, a cause of concern for Gold’s (XAUUSD) rallies in the short run, was reported in our recent write-ups. Bearish patterns, such as, shooting star and hanging man are traced out at the stiff resistance levels of $1,528 that hamper the prospective 6-1/2 years highs. Consequently, the current price slid below DMAs.

OTC Updates for Bullion Market:

Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks. One could see the bullish risk reversal setup. To substantiate the above bullish sentiment, risk reversal (RRs) numbers indicate the overall bullish environment.

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in the future.

Options Strategy: Capitalizing on the prevailing dips of gold price in the short-run and OTC indications, bullish neutral risk reversals of gold, we advocate longs in gold via ITM call options.

Buy 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If the expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in August month’s CME gold contracts. We now like to uphold the same strategy by rolling over the contracts for September’19 delivery as we could foresee more upside risks. Courtesy: Sentrix, JPM & Saxobank

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis