The bullion price gains considerably from last couple of days, especially after gold testing the strong support at $1,547 levels). But to begin this week, these price gains have been pared with profit booking sentiments. The net gold longs surged USD3.925bn to just shy of USD50bn in the week equivalent to 328k contracts a record which surpasses the 2016 peak bullishness for the yellow metal.

OTC Updates:

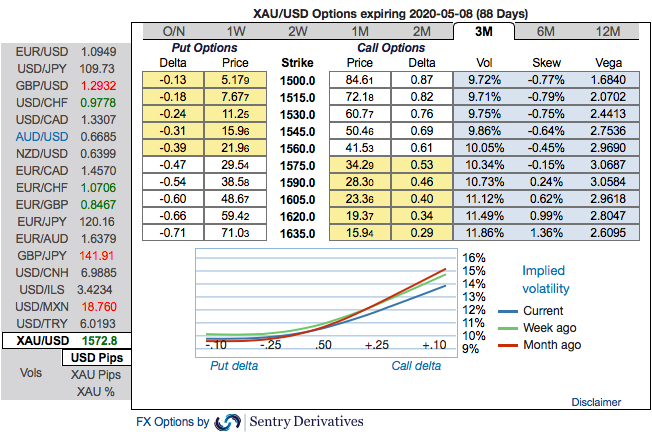

The 3m positive skewness of gold options contracts implies more demand for calls (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to $1,635 is quite evident that reminds us hedgers’ inclination for the upside risks.

One could also see the fresh bids for the existing bullish risk reversal setup. To substantiate the above-mentioned bullish sentiment, risk reversal (RRs) numbers also indicate the overall bullish environment (2ndnutshell). Well, we know that options are predominantly meant for hedging a probable risk event in future.

Hedging Strategies:

Capitalizing on all the above fundamental drivers and OTC indications, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions CME gold contracts of 2019 deliveries. We again upheld the same strategy by rolling over the contracts for March’2020 delivery as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid geopolitical turmoil and the global financial crisis. Courtesy: Sentry and Saxobank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts