The moment when EU chief negotiator Michel Barnier offered the British side an extension of the transition period (between leaving the EU and the final post-Brexit relations coming into force) by two years, the standpoints have been interpreted as a GBP positive signal spontaneously.

Well, two more years to clarify the future relationship and to negotiate something more constructive than the backstop solution, wouldn’t that be great? Until I realised that the extremists on the British side are likely willing to reject this offer. If only because the UK would then have to pay its EU contributions for another two years.

Primarily, the indication that the UK and the EU are closer to an agreement than perceived markets, which has come to light now that the budget is set to be passed. Our economists now think it increasingly likely that a deal will be finalized by the December 13-14 council meeting.

Secondarily, the news reports indicated a favorable outcome for UK in relation to financial services (British banks could get access to the EU after Brexit). Given these developments, we recommend tactical GBP longs vs EUR this week. The trade is recommended through options given that headline risk around getting the agreement passed in the Parliament will be high in the coming weeks.

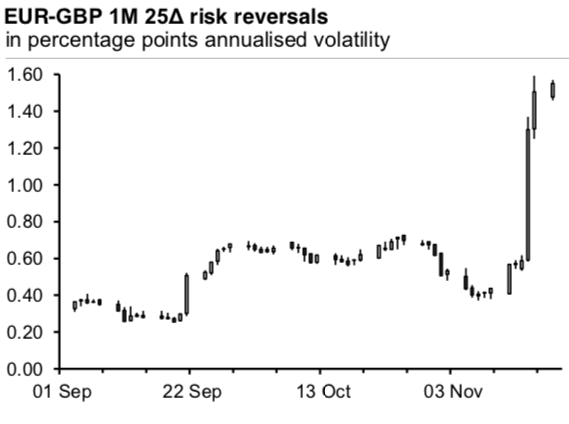

At this juncture, the GBP exchange rates are holding their post-Thursday levels. However, that should not disguise the high (yes, even rising) nervousness on the markets. Proof is the renewed rise in EURGBP risk reversals, which price in an even bigger risk of collapse of Sterling than last Thursday (refer above chart).

The recommended structure is with capped downside given headline risk relating to getting the deal passed in UK parliament and is a (ratio) put spreads given already-rich GBP vols and given expectations of limited upside.

Trade tips: Buy 2m 1x1.5 EUR put/GBP call 0.87-0.8550 RKI 0.84 for 38.9bp (spot ref: 0.8890 levels).

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -12 levels (which is mildly bearish), hourly GBP spot index was at -95 (bearish) while articulating at (13:02 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios