After an action-packed last week, GBP faded in the background this week with no major developments. The Bank of England voted unanimously to raise the Bank Rate by 25bps to 0.75 percent on August 2nd, saying recent data appeared to confirm that the dip in output in the first quarter was temporary and that the labour market has continued to tighten and wage growth has firmed.

On the flip side, Brexit developments have been put on the backburner for the next few weeks with the UK parliament on recess until September 5thand while Barnier indicated that the Withdrawal agreement will not be finalized without a solution to the Irish backstop, this was expected and didn’t have a market impact.

However, noise around a no-deal in March 2019 has been increasing over recent weeks and has started to weigh on market pricing.

Needless to say, a hawkish outcome has entailed fewer dissents and a higher long-term equilibrium rate.

Nonetheless, in our view uncertainty relating to Brexit will limit the optimism around GBP in our view and we continue to find value in staying short.

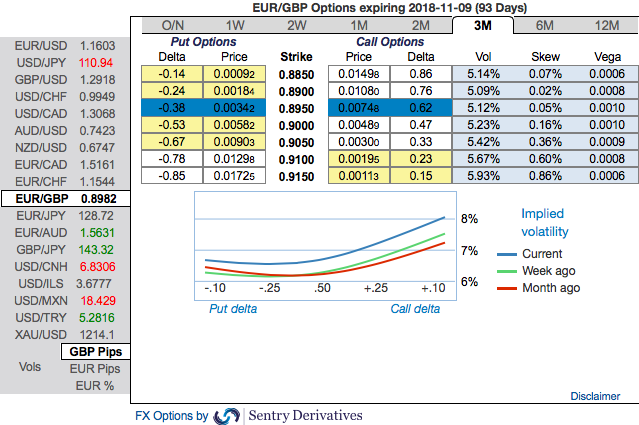

Based on above driving forces, hedgers seem to be factored-in OTC markets. At spot reference levels: 0.8982, please be noted that the positively skewed IVs of 3m tenors are well balanced either side (interests towards both OTM calls and OTM puts) but signify the more hedgers’ interests to bid OTM call strikes upto 91.50 levels (refer above nutshell evidencing IV skews). As you could observe EURGBP forward rates, these derivatives instruments also indicate bullish targets of this pair.

Risk reversal of EURGBP is also signalling bullish risks in both short and longer-term tenors (refer 1m/6m bids in above nutshell showing risk reversals).

Hence, we advocate staying long in EURGBP via diagonal credit call spread on hedging grounds that addresses both short-term downswings and long-term upside risks.

Keeping the both fundamental and OTC factors in mind, it is advisable to initiate long in 3M ATM 0.51 delta call, simultaneously, writing 1m (1%) ITM call with positive theta (both sides use European style options), this credit call spread option trading strategy is recommended when the underlying spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

In addition to that, add short in spot GBPCHF at 1.3051, stop at 1.3350. Marked at +0.02 %. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -142 levels (which is highly bearish), while hourly EUR spot index was at 18 (neutral) and CHF at -35 (bearish) while articulating (at 08:12 GMT). For more details on the index, please refer below weblink:

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices