As expected, RBNZ maintained status quo in their monetary policy, kept OCR unchanged at 2.25%.

But the central bank still believes that there is room for another rate cut than not in the coming months.

With economic conditions improving recently, the RBNZ shared the assessment that it was worth waiting a bit longer to make that call.

We continue to expect one more OCR cut this year, probably in the August Monetary Policy Statement.

The strength of the New Zealand dollar is a downside risk for the RBNZ’s inflation forecasts, while strong credit growth is an upside risk. Thus, we reckon that there could be a turnaround also in AUDNZD when the central bank goes hawkish in their next policy.

Having said that, accordingly we had recommended credit call spread strategy exactly a month ago.

We believe that the shorts in ITM calls would have certainly fetched decent yields but long calls may have gone in vain. But no worry, the portfolios was constructed on net credit so the net-to-net P&L must be positive.

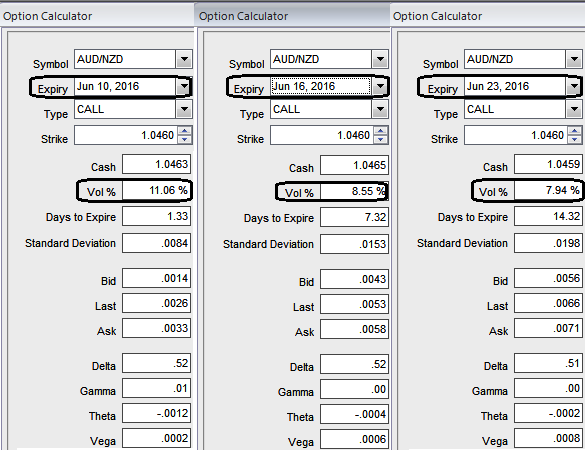

We would again like to build the same strategy again resembling ITM shorts and OTM long calls, use narrow expiries (preferably 2w on the short side and 1m on the long side).

The rationale remains same, the lower strike short calls are intended because IV is on the lower side and short term trend is slightly weaker and it finances the purchase of the higher striking call (ATM calls are overpriced, so we chose 0.5% OTM calls as well) and the position is entered for nil cost.

Please be mindful of how IV shrinks away over the period of time.

Also please refer below link for our previous write up on CCS strategy; shorts have immediately reacted the moment when we advocated on 25th April:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge