The Bank of England is unlikely to increase rates today. However, we do expect a rate rise of 0.25% in May and will be looking to see whether it signals that intention today. Ahead of the November meeting, the BoE signaled its intentions with a comment reading “some withdrawal of monetary stimulus is likely to be appropriate over the coming months” at its September meeting. Markets will, therefore, be looking for a similar signal today, the risk is that with so much expectation priced in, a lack of a signal may cause a re-pricing.

GBP itself is close to range highs versus the EUR and USD. MPC member Ramsden is due to speak this afternoon. Before the BoE, we get the latest retail sales readings. While a volatile set of data, the last couple of readings have been underwhelming, with the three-month growth rate slowing to 0.8% in January from 1.2%. We look for a 0.5% rise in February.

Options trading strategy:

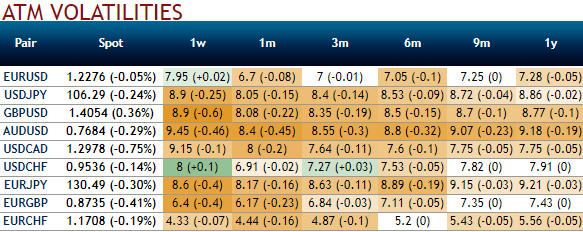

Please be noted that the 1m EURGBP IVs are shrinking below 6.25% among G7 FX bloc with bullish neutral risk reversals.

The volatility is the heart and soul of options trading. With the proper understanding of volatility and how it affects your options, you can profit in any market condition. The markets and individual asset class are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our options strategies.

When we talk about volatility we are referring to implied volatility. Implied volatility is forward-looking and shows the “implied” movement in an underlying asset’s future volatility.

Hence, to keep these volatilities on the check, we advocate options strategies as shown in the above diagram (ORE offers customized options strategies on EURGBP):

Strategy overview: The options trader reckons that the EURGBP spot price would be in a tight range with lower volatile like before.

The execution: On trading grounds, short 1m (1.5%) out-of-the-money call and (1.5%) out-of-the-money put of the similar expiry for the net credit.

Profit potential: Limited.

Risk profiling: Unlimited.

Margin: Margin needed.

Keep in mind: Position likely to gain its value with the passage of time as the TVM decreases.

This strategy is suitable when trader ponders that the market won’t be less volatile and broadest range bounded.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -69 (which is bearish), hourly GBP spot index was at 57 (bullish), while articulating at 10:32 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025