The pound sterling should not suffer too much. An interest rate hike by the Bank of England (BoE) next week is now the consensus opinion in the market. And so the fundamental difference between BoE interest rate policy and ECB interest rate policy is strengthened and made clearer. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

While the uncertain interaction between contingent trade war risks and the BoC policy reaction function adds to opaqueness in the rate outlook. The recent time’s policy communication from the BoC emphasized delineation between incorporating realized trade policy impact into its forecasts and policy decisions, and deliberately not taking account threatened but unrealized trade actions (e.g. potential future auto tariffs).

Despite drastic volatility in the energy markets, Western Canada Select Crude continues to trade at $50/bbl that stimulates CAD’s strength. If any headwinds in the form of domestic supply disruptions possibly into September (7.5% domestic daily production), plus pronounced spreads vs elevated WTI prices will limit CAD’s upside from additional oil price support.

Option Strategic Framework:

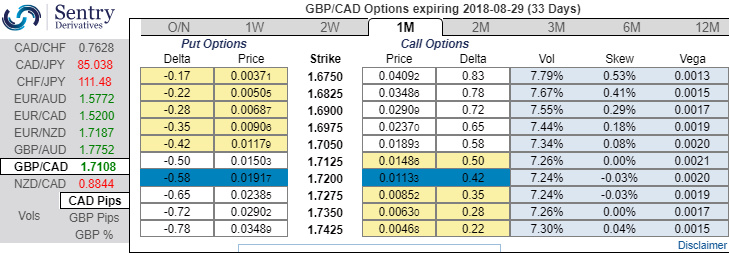

Please be noted that the positively skewed IVs of GBPCAD of 1m tenors is well balanced on either side (refer below chart), technical trend (both minor & major) and above stated fundamental driving forces of this pair have been indicating perplexities which means hedgers’ sentiments of this pair may head towards any directions but with more potential on downside in the near-term.

Accordingly, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.7941, initiate long in 1M GBPCAD at the money +0.51 delta call, add one more lot of 1M at the money -0.49 delta put and simultaneously, short 1w (1%) out of the money call with positive theta. The short leg with narrowed expiry (lower side) likely to reduce total hedging cost. Courtesy: Nomura

Currency Strength Index: FxWirePro's hourly GBP spot index is at shy above -17 levels (which is bearish), while hourly CAD spot index is edging higher at 65 levels (bullish) while articulating (at 10:24 GMT). For more details on the index, please refer below weblink:

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty