Bank of England left its monetary policy unchanged but the dissenting votes for an immediate 25bps hike, from the current Bank Rate of 0.50%, rose from two to three (Chief Economist Haldane, who has broken ranks verbally before, joined known hawks McCafferty and Saunders). In addition, due to the generally lower levels of rates, the Bank lowered the rate at which they would consider altering their asset holdings to 1.5% (from 2.0%). That remains a distant prospect given that their outlined path of three 25bps rises is over the next three years. The statement and minutes confirmed their prior view that the economy was recovering as projected and that 1Q weakness was temporary.

Over 2018, we see scope for some further underperformance from NZD, as we expect ongoing confirmation that the RBNZ can credibly lag policy normalization in the G3. Evidence that real assets (equities, housing) are threatened by late cycle growth dynamics and government intervention would add further weight to this story. NZDUSD is expected to depreciate to 0.66 by 2Q’19.

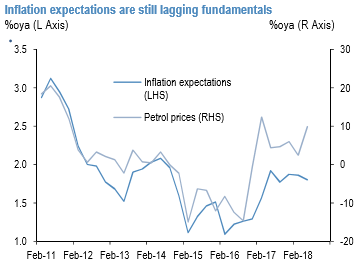

RBNZ Governor Orr’s first MPS maintained the low for long policy guidance, with an evenly balanced outlook for the near-term. The Governor stated the next move is equally likely to be up or down and has placed significant weight on the fact that inflation expectations have become more backward-looking, which slows the recovery from several years of below-target outcomes. Such headwinds were highlighted in the most recent RBNZ expectations survey, where 1Y forward expectations remain lower than would be expected, in the context of rising oil prices (refer 1st chart).

NZD faces domestic headwinds to local rates that are only now being fully appreciated. Growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government.

While the Aussie has been one of the worst performers in the broad-based US dollar rally since the June FOMC and ECB meetings. But the RBA should also be optimistic on Australia’s growth outlook in its Aug statement. Courtesy: JPM & Westpac

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -26 levels (bearish), while hourly USD spot index was at -110 (bearish), GBP flashes at 139 (bullish) and AUD at 35 (bullish) while articulating at 07:32 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data