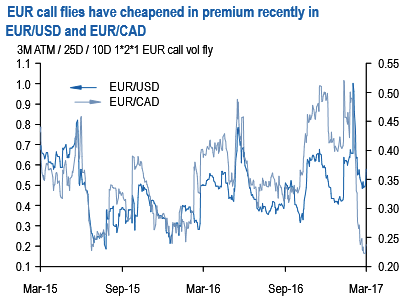

Along similar lines of EURUSD, we also like EUR call/CAD put flies.

The macro view on CAD is negative on a mix of BoC dovishness, sensitivity to NAFTA renegotiation talk which is likely to re-enter headlines over the next few weeks, and the potential for further near-term slippage in oil prices.

We introduce a Bank of Canada rate hike forecast for 3Q18 but would need to see a shift in tone to move it forward

Despite a strong run of Canadian data, the Bank of Canada has retained a dovish tone in its communications in recent months. This week continued that pattern, with Governor Poloz reiterating his belief that the Canadian output gap remains large, but January GDP subsequently surprised strongly to the upside. Our nowcaster now looks for 4.8% SAAR GDP growth in 1Q; we raise our forecast to a more cautious--but still robust--3.8%.

Hence, option pricing heavily favors EUR call/CAD put fly ownership, which are near 3y lows in premium (refer above chart).

2M 1.46 – 1.49 with 1.52 RKI –1.52 EUR call/CAD put flies indicatively cost at 35 bp EUR (spot ref. 1.4260, max payout ratio 5.8 times if RKI triggered, 11.4 times if not).

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal