Swiss franc vols and correlations have soared following the recent spike in EURCHF. USDCHF 3M3M FVAs have lagged the upturn and are value buys along a mildly inverted curve.

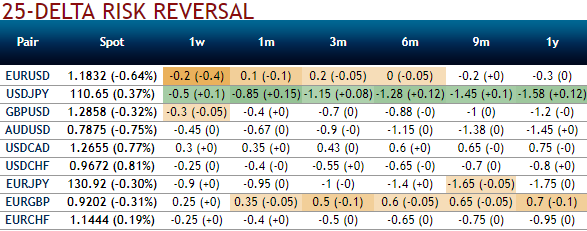

Please be noted that the risk reversals are oriented towards OTM calls and puts, while USDCHF IV skews signify hedging interests have been well balanced but slightly favoring bearish sentiments, showing that the option market expects less volatility on the downside, which is consistent with the negative correlation between the FX rate and its implied volatility that we have observed since May (refer above IV nutshell and graph).

Hence, with a view to arresting puzzling swings, we’ve advocated below options strategy.

Buy USDCHF 2m call spread 1x2, strikes 0.9825/1.0150 (spot ref: 0.9612); Maximum leverage at 1.0150: 8 times The payoff obtained with this strike setting takes advantage of the USDCHF trading at the upper half of its 0.9450/1.0350 two-year range. As the structure sells convexity, the maximum potential leverage can only be monetized at the expiry.

Shorting volatility within the USDCHF range Risk aversion generated turbulence at the bottom of the USDCHF range, but price action should now become less volatile.

Given the tail risk, we are not inclined to sell unlimited CHF upside. From now, the higher USDCHF should, therefore, pressure volatility, suggesting a short volatility structure.

Risk profiling: Topside break even at 1.04, above USDCHF multi-year peak Investors, buying our call spread ratio (double notional on the highest strike) face unlimited risks if the USDCHF trades above 1.04 at the 2m expiry. The structure is designed such that this topside break even lies above the USDCHF double top at 1.0350 observed since the SNB removed the CHF cap in early 2015, a level not exceeded since 2010.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?