Although the depreciation pressure due to global factors and risk-off sentiment recently eased somewhat, the rand was not able to benefit, as domestic factors such as the forthcoming rating review and the upcoming elections in May are having a negative impact. Weak economic data puts additional strain on ZAR.

In January, production in the manufacturing sector fell seasonally adjusted by 2% mom, while the December result was revised up to +1%. Compared to the previous year, however, output grew by just 0.3% after 1.2% in December. Looking at the leading indicators, there is no hope of an improvement in the near future. The purchasing managers' index for the manufacturing sector slipped back into recession range in February. And the quarterly Business Confidence (BER) recently fell to its lowest level since June 2017. These are currently not good odds for the Rand, which we see for the time being under pressure to sell.

Above all, the uncertainty about the rating review on 29 March is likely to lead to increased nervousness on the markets and thus to stronger fluctuations in ZAR exchange rates.

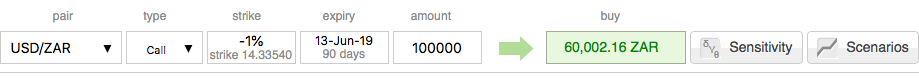

Trading tips: We advocated 3m USDZAR (1%) in the money call on hedging grounds. At spot reference: 14.4666 levels, we continue to uphold the same strategy as the underlying moves are foreseen to sense upside risks, a deep in the money call with very strong delta would most likely to move in tandem with the underlying moves. Courtesy: Ore & Commerzbank

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 3 levels (which is absolutely neutral) while articulating (at 13:14 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts