The results of the US elections has caused turbulence in almost all asset avenues including EMFX as the Republican candidate Donald Trump is crowning as the 45th president of the United States on Wednesday, crushing the potentials for a victory by Democrat Hillary Clinton.

As a result, the volatility of the rand is the expression of grave concerns amongst investors that the political situation in South Africa still seems to be fragile and getting further out of control. USDZAR has spiked vigorously to hit the highs of 13.8257 but soothes to the current 13.4221 levels, is this an early signal of bullish pressures of USDZAR and how to keep this risk on a check? Our below option strategy advocates this perplexion.

When the resilience around dollar owing to the much awaited US election has come to an end, on the one hand, there is President Jacob Zuma and his supporters who are implicated in various corruption scandals that may still cause some sort of pressure on ZAR.

With the ZAR near its strongest level in the past year, we believe that there are better opportunities in other high yielders (BRL, RUB, IDR for instance).

South Africa’s tight economic links to China (10% of total exports, declining but still the highest in EMEA) and high correlation to the commodity complex mean that the ZAR remains a good proxy for China originated global turbulence.

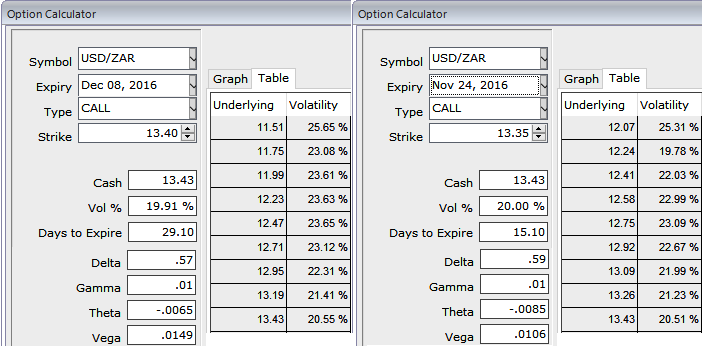

Option Strategy:

A glance at the implied 1-month volatilities screaming off crazily that illustrates the whole crux of the matter: at 19.9% ZAR is the currency with the highest volatility at present among G20 FX space.

Long USDZAR in cash was stopped out, instead, open option spreads.

Anticipating further price upswings in the underlying spot of USDZAR, on hedging front, we recommend positioning long USDZAR (ZAR has been significantly overshooting fundamentals), which makes buying USDZAR vol all the more appealing.

In naked vanilla form, we suggest call spreads at the 1M horizon, optimizing strikes for leverage. In USDZAR, the 1M-2M ATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly.

In order to ensure more than 50% discount to the outright vanilla, and a max payout/cost higher than 3.4:1, one needs to choose a combination of long 1m vs 2w.

The call spread achieves a 55% discount to outright call and a max payout/cost ratio of 3.8:1 (mid values).

We believe our arguments still hold for a further ZAR weakness, but we acknowledge that the progress may be slower than we initially expected with anecdotal evidence suggesting positioning has been short ZAR. The lack of immediate negative headlines has led to a short squeeze in the currency.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts