The robust US dollar depreciation realized since mid-December seems to have been stopped for now and most recently the US currency was able to regain some lost ground again. There is only one currency in the G10 universe that did considerably well since early February and that is the Japanese yen. JPY’s outperformance for the past two weeks has been remarkable: JPY appreciated to the highest level in 5 months in nominal weighted terms.

If at all USDJPY is projected to slide towards 100 on following driving forces, the below options strategy is advocated on hedging grounds.

The factors that likely to drive further USDJPY weakness:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) The expectations for more hawkish than expected personnel change of the BoJ heighten.

Options trades recommendations:

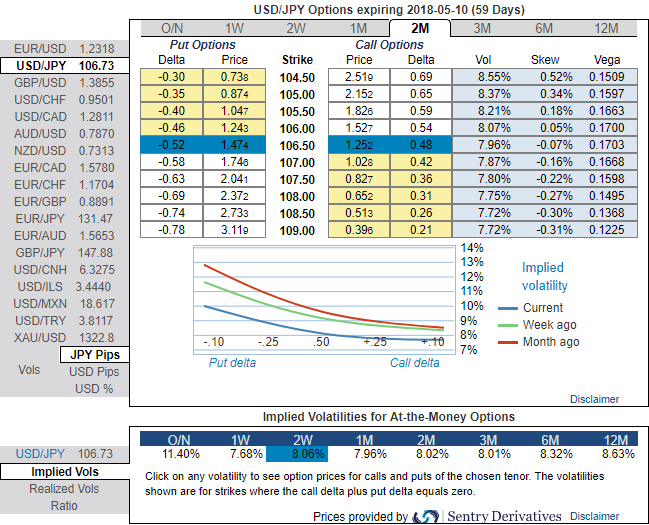

The implied volatility of ATM contracts of USDJPY is trading at around 8.06% and 8.02% for 2w/2m tenors, as the positively skewed IVs of 2m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders. Despite the positive shift in risk reversal numbers, the hedging sentiment for the bearish risks appears to be intact.

Thus, we advocate buying USDJPY 2w/2m put ratio back spread strikes 107.771/106.036 (2 lots), (vanilla: 0.75%, spot ref: 106.572). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of OTM put.

The maximum loss for the put backspread is limited and is incurred when the underlying spot FX at expiration is at the strike price of the long puts purchased.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -32 (which is bearish), while hourly JPY spot index was at -92 (bearish) while articulating at 07:37 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge