In this write-up, we emphasize on longs in CME gold, at the end of April, the dollar definitively broke out of a narrow range established since mid-January. The move higher in the 10-year Treasury yield was chiefly cited as the driver for the 2% move higher in the broad dollar index. The dollar’s resurgence since April 18 synced with the surge in yields but also the 2% drop in spot gold prices.

This sequence of events would normally be considered mundane were it not for the fact that the typical persistently-negative relationship between yields (both nominal and real, short-term and intermediate), and the gold price has broken down since last October.

It is still early days and debatable whether the period of decorrelation has ended. Given that our FX strategists maintain forecasts for a weaker USD over the next couple of quarters, we prefer to keep our long gold trade recommendation in place for now.

OTC outlook:

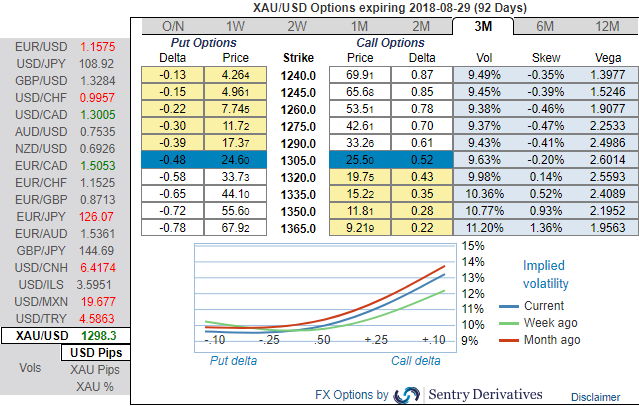

As you can see 3m IV skews, that have been indicating potential upside risks, this signifies the hedgers’ interests on both OTM call strikes. While bullish neutral risk reversals have been indicating hedging sentiments for the upside risks remain intact, accordingly, deploying three-leg options strategy would be a smart move to reduce hedging cost. 3m IVs are trending at a tad below 9.6%, while 1m IVs at 9.2%, this combination of IVs are conducive to construct diagonal spreads like options structures.

Thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check.

Options strategy:

Risk-averse traders who are uncertain about trend directions, go long in XAUUSD 3M at the money -0.49 delta put, and go long 3M at the money +0.51 delta call and simultaneously, Short 1m (1%) out of the money puts. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

Alternative strategy: Initiated longs in CME gold for Dec’18 delivery at $1,352.80/oz in February 2018. Added an equivalent positions at $1,327/oz in March 2018 for a new entry level of $1,339.90/oz. Trade target is $1,540/oz with a stop at $1,273/oz.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary