GBP fell further than expected in the aftermath of the UK vote to leave the EU and after the MPC eased policy at the start of August. Since then, a bounce in economic indicators has been accompanied by a GBP bounce to levels where fresh shorts, vs EUR, are attractive.

The UK economy was slowing before the referendum and the additional uncertainty from the vote will only exacerbate that downtrend. The initial weakness of (mostly) survey data pointed to an economic hit but overstated the near-term magnitude. The better recent data confirms the sky didn't fall, but a long period of corrosive economic uncertainty still lies ahead.

The current 67bp 2yr rate differential between the UK and euro reflects market expectations of ECB rates falling by around 15bp by the end of 2017, and a 68% probability that UK rates are unchanged at the end of next year. From here, there’s a strong risk of rate spreads moving in the euro’s favour.

OTC outlook:

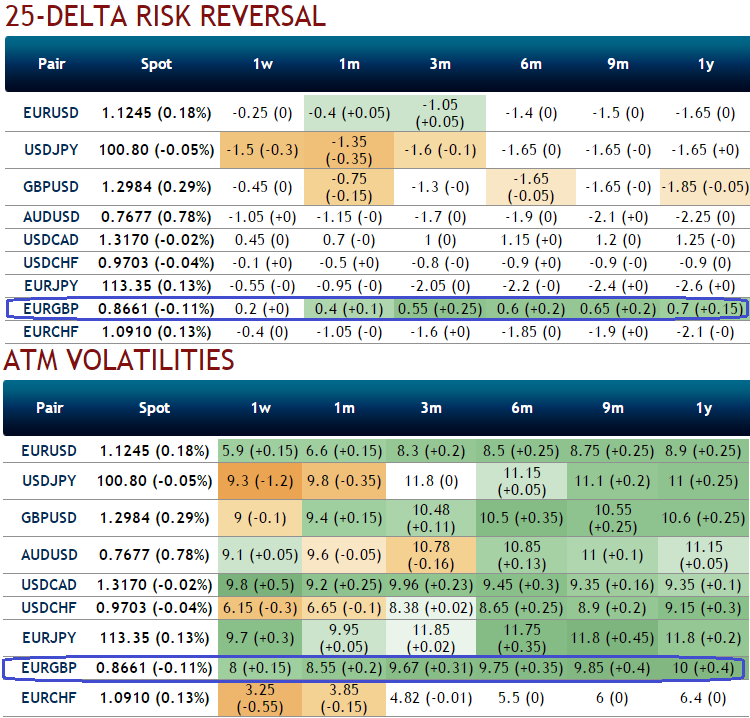

The implied volatilities of ATM contracts for near month expiries of EURGBP are spiking at around 8-9% which is a decent IV among G10 FX space.

While delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for upside risks over the period of time.

While current IVs of ATM contracts are at higher levels, these are positively skewed towards OTM call strikes and likely to perceive hover around at an average 9% in the long run that would divulge pair’s gain contemplating risk reversal arrangements.

Hence, considering above OTC market reasoning and fundamental factors we think upside risks are on the cards, as a result we reckon deploying ATM instruments in hedging strategies are worthwhile.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient