Quick glimpse at some fundamentals:The most noteworthy release today would be the publication of the ECB’s account from the 13 September Governing Council meeting, when the reduction in the rate of net asset purchases from the start of October was confirmed and the staff forecasts for GDP growth and core inflation were nudged lower. ECB is scheduled for monetary policy on 25thOctober. Italy thatis a tall order since even with the de facto assistance of ECBQE in suppressing yields, the cost of debt servicing amounts to 2.9% on a 132% of GDP debt stock.

The EUR remains subdued due to Italian budget risks. Meanwhile, today’s ECB minutes would be scrutinised for clarity regarding the additional comment in their post meeting statement which referred to the risks to the economy from protectionism and emerging markets.

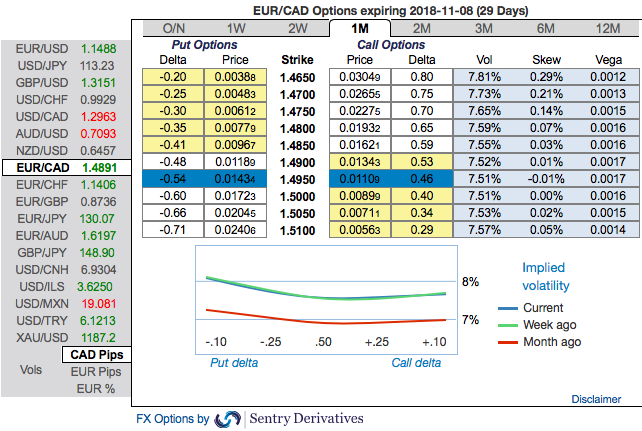

EURCAD has slid from the peaks of 1.6153 to the current 1.5096 levels in last couple of months. Further material downside from the current levels will likely only come on a gradual basis as USMCA ratification steps are achieved and as Canadian cyclical upside from the “peace dividend” becomes gradually apparent justifying a more BoC hikes than currently priced. BoC monetary policy is also scheduled for this month (precisely on 24thOctober), rate hikes more imminent.

EURCAD OTC outlook:

Please be noted that the 1m IV skews have been well balanced on either side and signify the hedgers’ interests on both OTM call and put strikes. Amid bearish sentiments with lower IVs are interpreted as conducive environment for writing overpriced OTM calls. Using three-leg strategy would be a smart move to reduce hedging cost.

Options Strategy:

Contemplating above driving forces and OTC indications, we advocate initiating longs in 1M EURCAD at the money -0.49 delta put, and go long in at the money +0.51 delta call of similar expiry and simultaneously, short 2w (1%) out of the money calls. Thereby, we favor slightly on downside risks as short leg likely to reduce long legs.

Currency Strength Index:FxWirePro's hourly EUR spot index is flashing at 79 (which is bullish), while hourly CAD spot index was at -101 (bearish) at 11:46 GMT. For more details on the index, please refer below weblink:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data