GBP has drifted modestly lower since the last post, so lacking the drama that has pertained to the euro during the last few weeks or indeed to GBP itself during April when the market was forced to mark down its views on BoE policy as it became clear that the economy had ground to a virtual halt in 1Q.

Bearish GBPUSD scenarios:

1) The rate hikes are delayed until much later in 2018 as core CPI continues to moderate and wages remain sticky below 3%;

2) The UK and EU fail to agree on the Irish border, leading to a non-negotiated Brexit);

3) Overt balance of payments pressure.

Bullish GBPUSD scenarios:

1) Hawkish BoE in coming months

2) A Parliamentary majority in favor of customs union membership frustrates a hard Brexit, the soft-Brexit amendments to the withdrawal bill in the Commons prompts a leadership challenge to May, maybe a general election.

3) UK Government won a key vote on the Brexit bill in the House of Commons yesterday.

OTC update and hedging grounds:

Let’s glance at GBPUSD sensitivity tool, the positively skewed IVs of 3m tenors are signaling the hedging interests in the bearish risks, 3m bids are upto 1.27 levels. As a result, OTM puts strikes likely to expiring in-the-money.

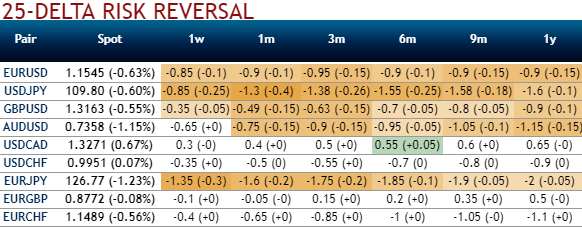

Refer negative risk reversal numbers across all tenors that indicates the hedging sentiments of this underlying spot FX prices are increased for bearish risks in both near and long-term which is in tandem with the technical analysis but bearish sentiments are mounting in medium-term basis (3m tenors).

In order to arrest downside risk that is lingering in the major declining trend, we recommend options strips strategy that favors underlying spot’s downside bias in the short-run and mitigates bearish risks.

Hence, we advocate building the FX portfolio exposed to this pair with longs positions in 2 lots of 3M ATM 0.51 delta puts and 1 lot of ATM -0.49 delta calls of 3m expiries, these options positions construct smart hedging at net debit.

The strategy is likely to mitigate both bearish as well as bullish risks irrespective of spot moves. However, on both hedging and speculative grounds as more potential is foreseen on the downside.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -42 (which is bearish), while hourly USD spot index was at 2 (absolutely neutral), while articulating (at 08:32 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data