Bearish EURUSD Scenarios:

1) Growth fails to rebound much above 1% and the ECB softens the guidance for the rate hike towards the end of 2019 or indeed even 2020,

2) The extended political protests in France followed by a populist tide at the European parliamentary elections in May,

3) The US imposes Section 232 tariffs on European car imports.

Bullish EURUSD Scenarios:

1) Fed ends the hiking cycle but with European growth back at .5-2.0% (so more 2006 than 2000;

2) The resolution to US-China trade conflict;

3) The continued strong CB demand for EUR.

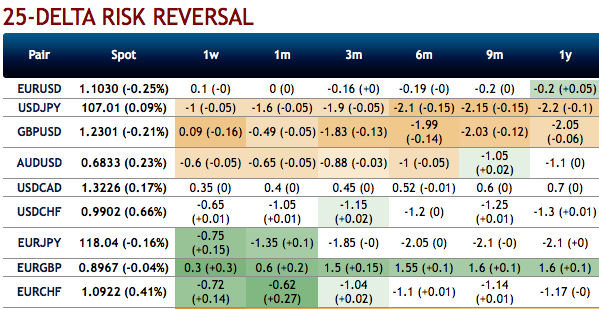

Most importantly, the FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiment remain intact.

OTC Updates: While 3m skews are stretched on either side (equal interest in both OTM call and OTM puts), 3m positively skewed IVs have still been signaling downside risks and upside risks as well. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks in the major downtrend.

To substantiate these indications, bearish neutral RRs across all tenors, which is in line with the above-stated bearish scenarios. But one could observe the positive shift in 1m tenors which is again as per the 1w skews.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

EURUSD’s upswings are observed from last 4-5 days ever since it has jumped from the lows of 1.0925 levels. However, the interim upswings unlikely to sustain in the long-run as it is struggling for the convincing buying momentum. So, we emphasized the bearish stance in the major trend in our technical section as well.

Hedging Strategies: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write an 1% out of the money put option of 2w tenors.

While, the dubious bulls but with hedging grounds, can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Alternatively, ahead of ECB monetary policy that is scheduled for this week, shorting futures of mid-month tenors have been advocated with a view of arresting further potential slumps, we now wish to uphold the same strategy. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, JPM & Saxobank

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics