Bearish USDJPY scenarios see 90 levels if:

1) The dollar weakness intensifies sharply on US-specific idiosyncratic factors;

2) Assessments for the prospect of a V-shaped global growth recovery are significantly tested;

3) Trade tensions between the US and China re-intensify with negative spillovers to Japan’s supply chain.

Bullish USDJPY scenarios see 115 levels if:

1) The outlook for the global economy recovers more sharply than expected and risk sentiment firms;

2) Momentum in JPY selling flows related to outward portfolio investment and FDI repeats on a similar exceptionally large scale as seen in 1Q’20.

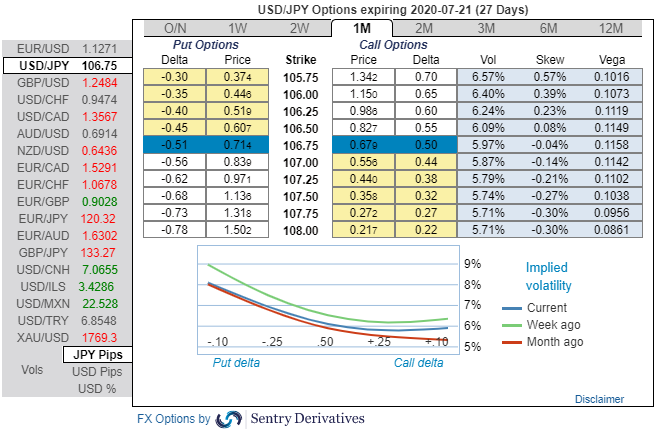

While our perspectives on Japanese yen against the dollar remains above 100 levels. If not for liquidity constrains a contained yen upside could be efficiently expressed via defensive USDJPY OTM put calendars that utilize the once in a generation skew-vol setup.

We opt for fading the curve inversion via vanillas on the weak side of the riskies to avoid left tail exposure.

OTC Outlook:

The positively skewed IVs of 1m tenors of USDJPY contracts are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 105.50 levels, whereas 1w skews signal both bullish and bearish risks (refer 1st & 2nd nutshells).

To substantiate this directional stance, one can trace out fresh bids of positive numbers for the existing bearish risk reversal numbers, this also signals current hedging interests for the downside risks amid mild upswings (3rd nutshell).

Trade recommendations:

1) At spot reference: 107.120 levels, we advocated buying a 2M/2w USDJPY 108.910/102 put spread (vols 8.95 vs 8.55 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

2) Advocated long in ATM/short 25-delta 3M USD put/JPY call spread @ USD 0.66% (when spot ref. 109.00, strikes 108.79/106.21).

3) Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we upheld the same positions, as the underlying spot FX likely to target southwards in the medium run. Courtesy: JPM, Sentry & Saxo

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand