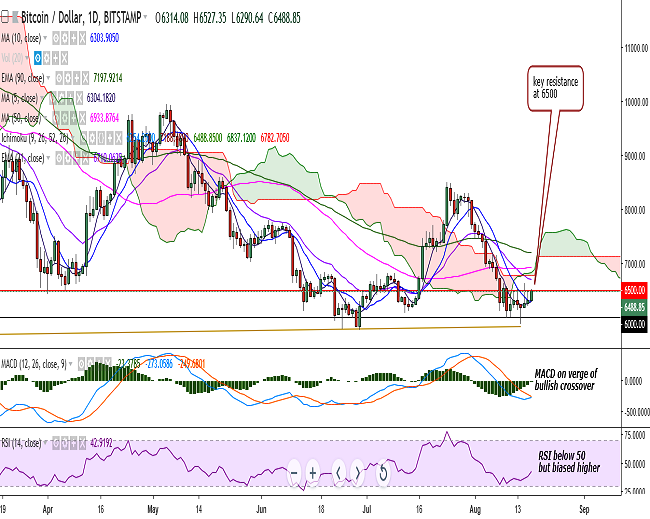

(Refer BTC/USD chart on Trading View)

BTC/USD is trading in the green on Friday as it is holding its strength well above 10-DMA.

The pair is currently hovering around 6500 levels at the time of writing (Bitstamp).

On the upside, a consistent break above 6500 would see the pair testing 6628 (4h 90-EMA)/6711 (21-EMA). Further strength would target 6782 (Cloud bottom)/6870 (20-DMA).

On the downside, support is likely to be found at 6380 (1h 50-SMA) and any violation would drag it to 6287 (2h 50-SMA)/6200. Further weakness would test 6120 (June 13 low)/6000/5920 (February 06 low).

On the daily chart, the pair is hovering around key psychological levels of 6500. Stochs have rolled over from oversold levels, MACD appears to be on the verge of a bullish crossover, RSI is below 50 with upward bias. Intraday bias is bullish at the time of writing.

A decisive break above 6500 levels, along with other bullish indicators, could see further jump in the pair. Further bullishness would be confirmed only on a break above cloud.

FxWirePro: BTC/USD hovers around 6500, decisive break above to see further upside

Friday, August 17, 2018 7:30 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary