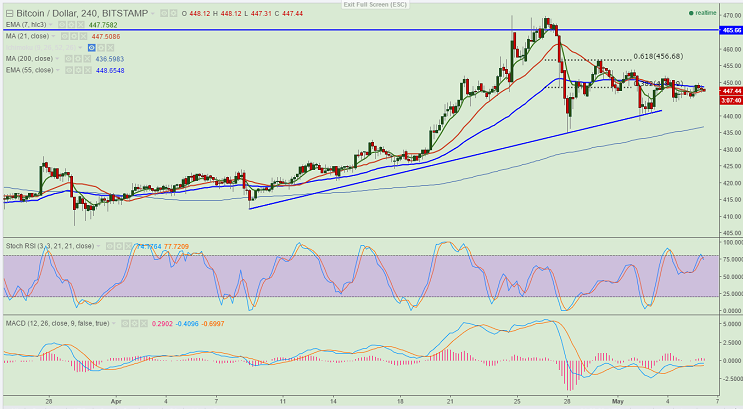

- Major resistance -$457 (61.8% retracement of $469.87 and $435)

- BTC/USD has recovered after making a low of $438.It is currently trading around $447.44.

- Short term trend is bullish as long as support $435 holds

- The pair’s major support - $435 (21 day MA) and any slight weakness can be seen only below $432.

- Any break below $435 will drag the pair down till $420 (55 day EMA)/$385 (200 day EMA).The minor support is around $453(7 day EMA)/$440.

- On the higher side resistance is at $457 and any indicative break above targets $470/$504/$550.

It is good to buy at dips around $445 with SL around $434 for the TP of $480/$504/$550.