AUD is suffering as a result of disappointing capex data and falling commodity prices early today. Since early February the Australian currency has been amongst the big losers within the G10 universe anyway, as it is suffering as a result of increased risk aversion on the markets. The Australian central bank (RBA) is likely to welcome the depreciation as it favors a rise in inflation towards its target.

We nonetheless assume that the central bank will not make the mistake again of sounding too optimistic too early so that the market immediately banks on the start of monetary policy normalization, causing AUD to trade firmer. Instead, the RBA is likely to be interested in the downside correction in AUDUSD continuing for a while.

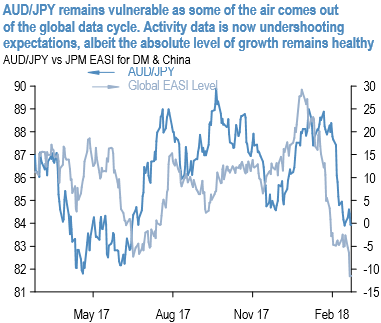

We identified AUDJPY as one of the G10 pairs most vulnerable in the month following a spike in equity volatility, even when the spike is transient and not accompanied by an economic downturn.

The performance in the two weeks since we initiated the trade is consistent with this pattern, and we remain comfortable holding the position as global growth expectations are being challenged by less emphatic activity data (refer above chart).

Our preference was for a covered put as we believed the options market had priced in an excessive level of tail-risk for the cross, and we note that both the level of vol and the risk-reversal for AUD puts have since abated.

Currency Strength Index: FxWirePro's hourly AUD spot index is displaying shy above -18 levels (bearish), while hourly JPY spot index was at 28 (bullish) while articulating (at 08:49 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch