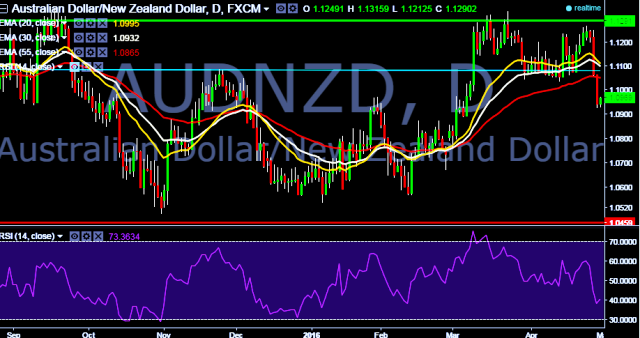

- AUD/NZD is trading around 1.0952 marks.

- Pair made intraday high at 1.0966 and low at 1.0926 marks.

- Australia's Producer Price Index fell 0.2% in the March quarter easing from 0.3% in the previous quarter and missing the market forecast of a 0.2% increase in the index.

- Intraday bias remains neutral till the time pair holds immediate support at 1.0924 marks.

- A daily close below 1.0924 will take the parity down towards 1.0890/ 1.0801 marks respectively.

- On the other side, a sustained close above 1.0976 will drag the parity higher towards 1.1062/1.1123/1.1298/1.1317/1.1352/1.1590 levels.

We prefer to take long position in AUD/NZD only above 1.0976, stop loss 1.0924 and target 1.1062/1.1123 marks.