Having total reported death cases across the globe exceeds due to the pandemic Covid-19, almost all markets have halted with a trauma. Latest data from John Hopkins University indicates 101,500 new confirmed cases worldwide on 4 April, vs 82,800 the previous day.

As the outbreak widens, the most severe impact on commodity markets (especially, crude oil demand) will be through aggressive travel curtailments. Efforts across the globe to contain the virus have already forced all economic activities to cancel, public gatherings to be suspended, and business conferences to be postponed.

RBA’s monetary policy is scheduled for this week, wherein status-quo policy is expected in this meeting.

Australian 3yr government bond yields ranged between 0.24% and 0.26%, respecting the RBA’s QE target, while the 10yr yield slipped from 0.76% to 0.72% before closing at 0.75%.

The effectiveness of the RBA’s QE program and yield target is focused from this meeting. A fair level for 3yr swap rates would be around 0.45%, but pandemic-related volatility will result in a wide range, say 0.30%-0.70%. The curve should flatten given RBA purchases out to 8yr maturities.

AUDUSD minor support is observed at 0.5980 which appears to be vulnerable.

The medium-term perspectives: The A$, as a proxy for global risk sentiment, will continue to remain under downward pressure. Global and AU economies are facing unprecedented shocks, and governments and central banks are responding with emergency actions. The next major technical support is at 0.5500 (1998 low).

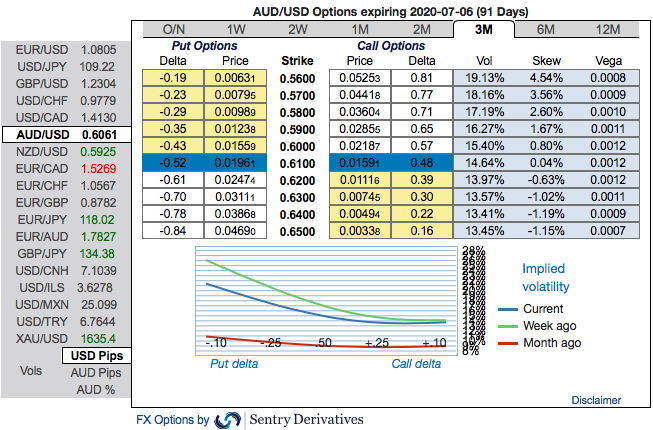

OTC Outlook of AUDUSD and Options Strategic Framework:

The positively skewed IVs of 3m tenors are also in line with the above predictions, they still signify the hedgers’ interests to bid OTM put strikes up to 0.56 levels (refer 1st chart).

Please also be noted that we see fresh bids for current bearish risk reversals (RRs) setup across all the longer tenors are also in sync with the bearish scenarios (refer 2nd chart).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear.

Diagonal debit put spreads have been advocated so as to suit the above OTC indications and mitigate the potential downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term potential to hit 0.6197 and fails from there onwards several times amid lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The execution of options strategy: At spot reference: 0.6062 level, short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry, Westpac and Saxobank

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts