Federal Reserve is scheduled for this week for their monetary policy. Of late, in the US, Fed policymakers have been very vocal about their worries that the economic recovery could falter with the rise in Covid-19. Last week’s reported increase in US jobless claims won’t alleviate those apprehensions.

The recent slide in the US dollar has continued with the greenback dropping by around 4% against the euro so far in July alone to around 1.17. The move against the pound has been less pronounced but has seen GBPUSD move up above 1.28 despite ongoing Brexit negotiations weighing on sentiment. But AUDUSD has continued to consolidate around 0.7100, the momentary upswings have taken halt at 0.7183 level.

The medium-term perspectives of this pair: AUD’s rally to above 0.71 coincides with the MSCI World index reaching highs since Feb, keeping the Aussie’s traditional positive correlation with risk appetite firmly intact. The Aussie’s support is broader than equities however, with commodity prices accelerating in recent weeks, especially iron ore and copper. Westpac’s index of Australia’s commodity export prices is up 21% since late April, reinforcing Australia’s current account surplus. Australia’s renewed Covid-19 containment challenge is a potential brake on gains, however. While the RBA does not favour either negative rates or FX intervention, the weakening domestic economic outlook could raise expectations that the RBA might take other steps to loosen policy to support the labour market, where unemployment is still rising. FxWirePro’s Q3 forecast is at 0.69 levels, though a soft USD should keep lending support near term. Accordingly, we’ve advocated suitable options strategy to hedge the puzzling swings.

Quick run through on options strategy:

Considering all the above factors, we could foresee the rosy times for the OTM overpriced put writing, accordingly, diagonal debit put spreads have been advocated so as to mitigate the potential downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term higher potential amid lower IVs was luring the OTM put options writing. While the medium-term perspective is attractive for bearish hedges via ITM puts.

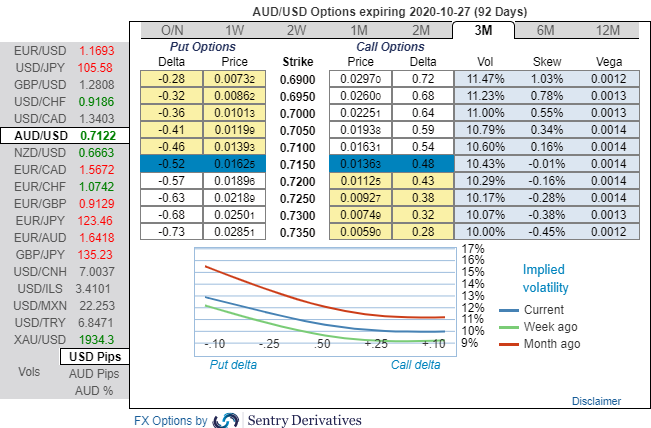

The rationale: The positively skewed IVs of 3m tenors are in line with the bearish expectations, they still signify the hedgers’ interests to bid OTM put strikes up to 0.69 levels (refer 1st chart).

While we see fresh negative bids for the existing bearish risk reversal (RRs) setup across all the longer tenors (refer 2nd chart).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear amid interim upswing expectations.

The execution: The above options strategy reads this way, short 2w (1%) OTM put option with positive theta (position functioned as per the expectations as the underlying spot has rallied considerably), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying spot FX. Courtesy: Sentry, Westpac & Saxo

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close