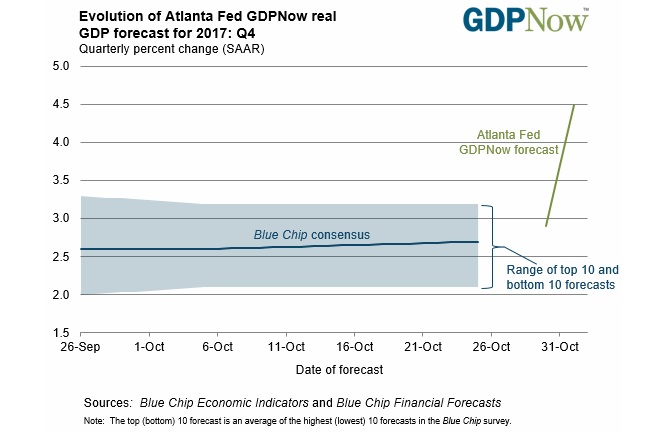

Atlanta Fed’s ‘GDPNow’ model is projecting 4.5 percent growth in the fourth quarter after yesterday’s release of ISM manufacturing PMI report for the month of October. ISM manufacturing PMI for October came at 58, while prices paid index came at 68.5 for the month.

The ‘GDPNow’ model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 4.5 percent on November 1, up from 2.9 percent on October 30. The forecasts of real consumer spending growth and real private fixed investment growth increased from 2.8 percent and 4.4 percent, respectively, to 4.1 percent and 8.8 percent, respectively. According to flash reading, the economy grew at 3 percent in the third quarter, marginally down from its 3.1 percent growth in the second quarter, which was the strongest growth since the first quarter of 2015.

U.S. Treasury has forecasted that under the current administration the U.S. growth would hit 3 percent mark. After U.S. third-quarter growth hit 3 percent mark, the U.S. Commerce Secretary Wilbur Ross said, “Today’s release of the gross domestic product growth for Q3 2017 proves that President Trump’s bold agenda is steadily overcoming the dismal economy inherited from the previous Administration. This is a remarkable achievement in view of the recent hurricanes which have shattered so many lives. As we work together to help those areas recover, I am confident that they will rebind stronger than ever before. And as the President’s tax cut plan is implemented, our entire economy will continue to come roaring back.”

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan